Introduction

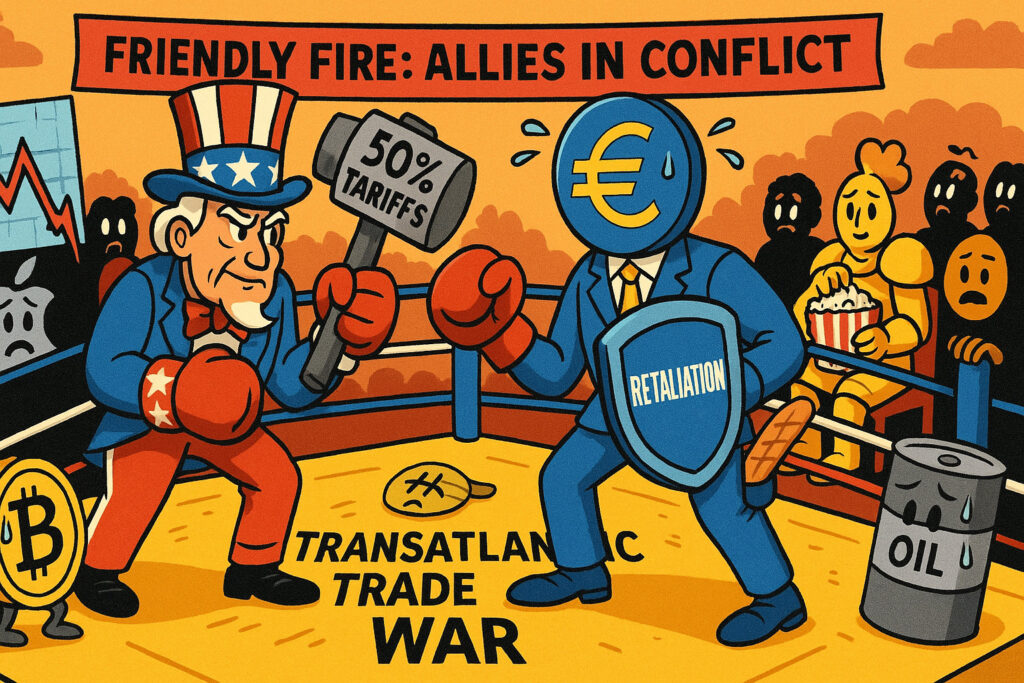

On May 27, 2025, global financial markets were roiled by the Biden administration’s announcement of a potential imposition of tariffs of up to 50% on a broad range of European Union (EU) imports. The U.S. Trade Representative (USTR) cited continued EU subsidies in the aerospace sector and ongoing digital service taxes targeting American tech giants as the main catalysts. The announcement drew immediate condemnation from Brussels and triggered a sharp reaction across equities, currencies, and commodities.

This renewed trade tension between the two economic superpowers threatens to undo recent transatlantic cooperation on trade standards and supply chain resilience. It also injects fresh uncertainty into global markets already grappling with sticky inflation, volatile energy prices, and divergent central bank paths. Investors now face a challenging environment where geopolitics and trade frictions could once again overshadow macroeconomic fundamentals.

Body

Tariff Announcement: Scope and Rationale

The proposed tariffs, unveiled late Monday by U.S. Trade Representative Katherine Tai, target approximately $100 billion worth of EU exports. These include industrial machinery, automotive components, luxury goods, agricultural products, and select consumer electronics. The administration claimed the move was necessary to level the playing field, citing the EU’s persistent subsidies for Airbus and digital levies that “disproportionately harm American innovation.”

The proposed duties are framed under Section 301 of the Trade Act of 1974, a statute often used to respond to unfair trade practices. According to preliminary documentation, tariffs could be imposed as early as July pending public consultation.

The EU has responded strongly. In a statement Tuesday morning, European Commission President Ursula von der Leyen condemned the announcement as “hostile and unwarranted,” pledging to pursue a proportional retaliatory strategy targeting U.S. agricultural exports and tech hardware.

Market Reaction: Equities Suffer Broad-Based Declines

Equity markets in both the U.S. and Europe fell sharply. The S&P 500 closed down 1.8% to 5,016, while the Nasdaq Composite lost 2.3%, weighed heavily by tech and consumer discretionary stocks. The Dow Jones Industrial Average dropped 1.6%, finishing at 37,820.

In Europe, the Euro Stoxx 50 index shed 2.4%, with German automakers like BMW and Mercedes-Benz falling over 5% on fears of retaliatory tariffs. French luxury giants LVMH and Hermès also tumbled nearly 4% amid concerns that U.S. tariffs would curb demand for high-end European imports.

Among U.S. stocks, Tesla (-4.7%), Apple (-3.9%), and Caterpillar (-3.2%) led declines, reflecting their international exposure and supply chain interdependence with European partners.

Sector-wise, industrials (-2.1%), technology (-2.5%), and consumer discretionary (-2.0%) were the hardest hit in the U.S. Energy (-0.7%) and utilities (-0.5%) provided relative outperformance amid the defensive rotation.

Commodities Mixed: Oil Retreats, Gold Gains

Crude oil prices dipped amid concerns that the trade conflict could weigh on global demand. Brent crude fell 1.3% to $83.45 per barrel, while WTI declined 1.5% to $79.87. Energy traders are also closely monitoring upcoming OPEC+ meetings for signs of production recalibration in light of shifting global growth dynamics.

Gold, by contrast, rose 0.9% to $2,385 per ounce as risk-averse investors sought safe-haven assets. The yellow metal continues to be buoyed by persistent geopolitical tensions, elevated inflation expectations, and a pause in Federal Reserve rate hikes.

Industrial metals were mixed. Copper slid 0.7% to $4.57 per pound, while aluminum and zinc also registered modest losses. The metals complex remains sensitive to both Chinese demand indicators and global trade policy uncertainty.

Currency Markets React Sharply

Currency markets reflected the transatlantic tension. The euro dropped 0.6% to $1.0725 against the dollar, as investors worried about the EU’s vulnerability in a protracted trade war. The U.S. Dollar Index (DXY) rose 0.5% to 105.36, supported by safe-haven inflows and prospects of stronger U.S. economic resilience.

The British pound was also weaker, falling 0.4% to $1.2640, amid concerns that UK-EU trade dynamics could be indirectly affected. The Japanese yen strengthened marginally to 154.10 per dollar as traders favored low-beta assets.

Emerging market currencies broadly weakened, with the Turkish lira and South African rand both dropping over 1%, reflecting broader risk-off sentiment.

Bonds: Flight to Quality Pushes Yields Lower

U.S. Treasuries rallied as investors rotated into safer assets. The 10-year Treasury yield fell 8 basis points to 4.28%, while the 2-year note yield slipped to 4.72%. The yield curve remained inverted, signaling ongoing investor skepticism about medium-term economic growth.

German bunds also rallied, with the 10-year yield declining to 2.42% from 2.51% a day earlier. Italian BTPs saw a smaller move, with spreads widening as peripheral risk came back into focus.

U.S. and European corporate credit spreads widened modestly, especially in export-sensitive sectors like autos, luxury goods, and capital goods.

Cryptocurrencies: Caught in the Crossfire

Digital assets faced selling pressure, with Bitcoin falling 2.8% to $66,750 and Ethereum down 3.4% to $3,390. Traders cited the broader risk-off tone and concerns that digital services taxes and enforcement measures might expand into the crypto sector.

Regulatory overhang remains significant for crypto markets, particularly in Europe where policymakers continue to push MiCA (Markets in Crypto-Assets) compliance frameworks. The threat of greater U.S.-EU digital trade friction may increase scrutiny of exchanges and decentralized platforms.

Economic Data Takes Back Seat but Remains Relevant

While geopolitical headlines dominated, economic indicators still provided valuable context. In the U.S., durable goods orders for April rose 0.3% month-over-month, beating the consensus forecast of a 0.1% decline. However, core capital goods orders (non-defense ex-aircraft) fell 0.2%, indicating a softening in business investment.

In the eurozone, the latest business climate survey from Germany’s Ifo Institute showed a decline to 89.4 in May from 90.7 in April, missing expectations. Sentiment fell across manufacturing, construction, and services, reflecting renewed concerns over export demand.

These data points underscore the vulnerability of both economies to disruptions in trade flows, which could aggravate slowing growth trajectories and complicate fiscal and monetary planning.

Central Bank Implications: No Immediate Shift, But Watchful Eyes

While neither the Federal Reserve nor the European Central Bank (ECB) are expected to respond directly to trade tensions, the new uncertainty could influence their forward guidance.

The Fed is widely expected to maintain its benchmark rate at 5.25–5.50% in its June meeting, given resilient core inflation and a robust labor market. However, if trade disputes escalate and impair growth, expectations for rate cuts in late 2025 could regain traction.

ECB policymakers, who have already hinted at a potential rate cut as early as July due to weak demand and disinflationary forces, may now face additional pressure to support confidence amid export uncertainty.

Market-based expectations (as reflected in Fed Funds futures and Euribor OIS forwards) now price in 0.75 percentage points of ECB cuts by year-end and only one Fed cut, down from two just last week.

Sectoral Outlook: Winners and Losers

Losers:

- Automakers: Both U.S. and European firms face supply chain disruptions, retaliatory tariffs, and lower demand.

- Luxury Goods: EU companies heavily reliant on U.S. consumers may face steep declines if tariffs are implemented.

- Semiconductors and Tech: Heightened digital taxation disputes may drag on transatlantic operations.

Winners:

- Domestic Industrials: Companies more focused on domestic markets may benefit from protectionist sentiment.

- Gold Miners and Precious Metals: Higher safe-haven demand supports both the commodity and equities linked to it.

- U.S. Agriculture (temporarily): Until EU retaliation materializes, domestic producers may benefit from diverted consumption.

Geopolitical and Strategic Context

This tariff escalation comes at a time when the U.S. and EU had been working to align trade standards in critical sectors such as clean energy, semiconductor production, and critical minerals. The move thus represents a significant pivot away from collaborative trade diplomacy toward retaliatory measures, possibly influenced by U.S. domestic political considerations ahead of the 2026 midterms.

Some analysts speculate that the move is designed to pressure the EU into faster concessions on digital tax disputes and carbon border adjustments. However, such tactics risk triggering a tit-for-tat spiral, especially given the EU’s readiness to defend its strategic industries.

The World Trade Organization (WTO) is likely to be drawn into arbitration, though its effectiveness has diminished in recent years due to U.S. opposition to Appellate Body appointments.

Conclusion

The U.S. threat to impose 50% tariffs on European imports represents a sharp escalation in transatlantic trade tensions. With financial markets already on edge due to persistent inflation and fragile global growth, the timing of this geopolitical jolt compounds investor anxiety.

The immediate market reaction—a broad sell-off in equities, strength in safe-haven assets, and weakness in the euro—reflects concern over the far-reaching implications of a renewed trade war. From automakers and luxury retailers to tech giants and bond markets, few corners of the global financial system remain untouched.

Looking ahead, the critical questions for investors include:

- Will the EU retaliate in full or pursue WTO adjudication first?

- Can diplomatic channels defuse tensions before tariffs are enacted in July?

- How might this conflict shape central bank outlooks and global investment flows?

For now, markets are pricing in heightened volatility and a cautious path forward. Investors should monitor U.S.-EU negotiations closely and prepare for portfolio realignment if trade hostilities intensify. In this climate, defensive sectors, dollar exposure, and quality growth stocks with limited international entanglements may offer relative safety.

The coming weeks could determine whether this is a short-lived tactical maneuver or the start of a broader strategic decoupling between two of the world’s largest trading blocs.