Introduction

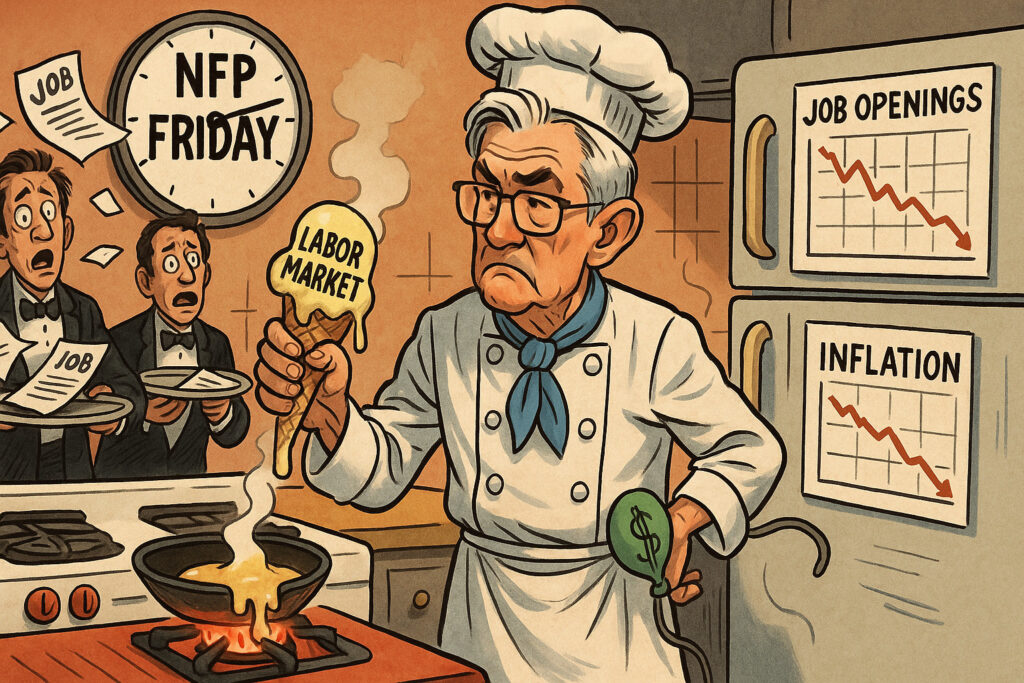

On June 3, 2025, newly released data from the U.S. Bureau of Labor Statistics (BLS) revealed a notable decline in job openings for April, signaling a gradual cooling of the American labor market. The Job Openings and Labor Turnover Survey (JOLTS) reported that vacancies dropped to 8.12 million, down from a revised 8.49 million in March, marking the lowest level since February 2021. This development precedes the highly anticipated Nonfarm Payrolls (NFP) report due Friday, setting the stage for market speculation on the Federal Reserve’s policy trajectory.

The decline in job openings adds to a growing body of evidence suggesting that the once-resilient U.S. labor market is softening in response to the Fed’s prolonged tightening cycle. Markets across asset classes reacted swiftly to the data, repricing rate expectations and adjusting risk exposures accordingly. With investors already on edge ahead of the NFP and the June Federal Open Market Committee (FOMC) meeting, today’s figures have injected fresh volatility into bond yields, equity indices, and currency markets.

Body

Labor Market Shows Signs of Moderation

The JOLTS report, widely regarded as a lagging but influential indicator of labor demand, showed job openings declining for the third consecutive month. April’s figure of 8.12 million came in well below consensus expectations of 8.4 million. Additionally, the quits rate—a measure of worker confidence—held steady at 2.2%, its lowest level since September 2020. This flattening suggests that fewer workers feel confident leaving their jobs for better opportunities, another sign of decelerating labor momentum.

By sector, declines in job openings were most pronounced in professional and business services, manufacturing, and retail trade. Healthcare and government postings remained more stable, indicating divergent pressures across industries. While layoffs remained relatively unchanged at 1.6 million, the trend in openings points toward a gradual normalization of the labor market after years of post-pandemic tightness.

Equity Markets React With Measured Optimism

U.S. equities closed mixed on Tuesday as investors digested the implications of the JOLTS data. The S&P 500 slipped 0.2% to 5,300.12, while the Nasdaq Composite edged up 0.1% to close at 17,832.75, supported by tech sector strength. The Dow Jones Industrial Average declined 0.4%, dragged lower by financials and industrials sensitive to macroeconomic headwinds.

Mega-cap technology stocks such as Apple (+0.8%) and Nvidia (+1.2%) helped buoy the broader market. These firms are less sensitive to short-term labor shifts and are seen as safe havens amid rising economic uncertainty. Conversely, shares of staffing companies and cyclical sectors like transportation and construction underperformed, reflecting concerns about hiring slowdowns.

Bond Market Signals Increased Rate Cut Bets

Treasury yields declined across the curve as investors re-evaluated the Fed’s policy stance. The yield on the 2-year Treasury note fell 8 basis points to 4.52%, while the 10-year yield dropped 6 basis points to 4.36%. The bond market is now pricing in a roughly 70% probability of a rate cut at the Fed’s September meeting, up from 58% before the JOLTS release.

The dovish repricing followed Fed Governor Lisa Cook’s remarks earlier in the day, where she acknowledged the risk of overtightening and stressed the importance of monitoring labor market data closely. While the Fed has maintained a higher-for-longer posture in recent months, signs of labor softening could pave the way for a pivot if inflation also moderates.

Dollar Weakens as Yield Differentials Narrow

The U.S. dollar index (DXY) fell 0.4% to 103.08 as the softer labor market data triggered a pullback in U.S. yields. The greenback weakened most notably against the euro, with EUR/USD rising 0.5% to 1.0912. GBP/USD climbed to 1.2805, its highest level in three weeks, while USD/JPY slipped to 154.90 amid easing rate divergence pressures.

Emerging market currencies such as the Brazilian real and South African rand also gained, benefiting from risk-on flows and expectations of a more accommodative Fed stance in the coming months. Traders will now closely watch Friday’s NFP data and June’s CPI figures for confirmation of labor and inflation trends.

Commodities Mixed Amid Macroeconomic Crosscurrents

Commodity markets responded with a nuanced reaction. West Texas Intermediate (WTI) crude oil rose 0.3% to $74.95 per barrel as investors weighed supply cuts from OPEC+ against slowing demand signals. Gold prices, which typically benefit from lower yields, rose 1.1% to $2,373 per ounce—approaching recent record highs.

Copper prices dipped 0.4% to $4.56 per pound as softer U.S. job openings reinforced concerns over industrial demand. Meanwhile, agricultural commodities were largely flat, with wheat and soybeans showing little movement amid stable global supply conditions.

Cryptocurrency Markets Extend Gains

Bitcoin rallied 2.5% to trade at $71,600, continuing its upward momentum amid declining real yields and increasing institutional inflows. Ethereum followed suit, gaining 2.1% to $3,880. The crypto market has been buoyed in recent weeks by optimism surrounding spot Ethereum ETF approvals and broader expectations of monetary easing.

Altcoins such as Solana (+3.4%) and Chainlink (+4.2%) also posted strong performances, with traders rotating into high-beta assets. The cooling labor market is seen as reducing the likelihood of aggressive Fed action, which typically weighs on digital assets.

Economic Outlook and Fed Policy Implications

Today’s JOLTS data will serve as a crucial input ahead of Friday’s May NFP report. Markets are currently expecting a gain of 180,000 jobs and a steady unemployment rate of 3.9%. However, a downside surprise—especially in conjunction with lower wage growth—could reinforce the case for easing policy sooner rather than later.

The Fed’s dual mandate of price stability and maximum employment is once again coming into sharper focus. While inflation has shown signs of slowing, with April’s core PCE rising just 0.2% month-over-month, labor market resilience had been one of the key arguments against rate cuts. A turning point in that resilience could prompt a reassessment of the Fed’s “wait and see” stance.

Fed Chair Jerome Powell is scheduled to speak next week, and his tone will be pivotal in shaping market expectations. If Powell acknowledges labor market softening while emphasizing inflation progress, the September meeting may become the market’s consensus for the first rate cut since 2020.

Conclusion

The decline in U.S. job openings to a three-year low is a significant development that may mark the beginning of a new phase in the labor market and monetary policy cycle. Investors are now recalibrating expectations around the Fed’s path, particularly with the May NFP data and June CPI release looming on the horizon.

Markets responded with a mix of cautious optimism and strategic defensiveness. Equities showed resilience in growth sectors, while bonds rallied on increased rate-cut speculation. The dollar weakened as rate differentials narrowed, and gold and crypto assets benefited from the shift in yield dynamics.

Looking ahead, the key question for investors is whether this softening in labor demand will be sustained and whether it will lead the Fed to adjust its stance sooner than anticipated. Will the NFP confirm a downshift in hiring? Can inflation continue its descent without triggering a hard landing?

As policymakers and markets search for balance, the cooling labor market may prove to be the signal that accelerates a broader pivot in the economic cycle. For now, caution and agility remain the order of the day.