Introduction

Date: April 26, 2025

Today, financial markets reacted sharply after the U.S. Bureau of Economic Analysis (BEA) reported a major slowdown in first-quarter GDP growth. The economy expanded at an annualized rate of just 0.8%, missing expectations for 1.5% and marking the slowest pace since the pandemic recovery period. Wall Street tumbled on the news, as investors recalibrated expectations for corporate earnings and Federal Reserve policy.

Background

Over the past several months, investors had been closely watching the U.S. economy for signs of cooling after a series of aggressive interest rate hikes in 2023 and 2024. Recent data had shown resilience: the labor market remained tight, inflation was sticky but trending lower, and consumer spending stayed surprisingly robust. However, cracks had begun to form. Manufacturing activity has been in contraction territory for six consecutive months, and recent retail sales reports suggested a waning consumer appetite.

Economists warned that the cumulative effects of higher borrowing costs, tighter credit conditions, and geopolitical uncertainties (including renewed tensions in the Middle East) could sap growth in early 2025. Today’s GDP print confirmed those fears.

Today’s Market Reaction

U.S. equity indexes dropped significantly following the GDP release:

- S&P 500 closed down -1.7% at 4,795.23.

- Dow Jones Industrial Average lost -1.5% to 38,652.10.

- Nasdaq Composite tumbled -2.3% to 15,045.12.

In commodities:

- Gold surged +1.8% to $2,361/oz, as investors sought safe havens.

- Crude oil (WTI) fell -1.1% to $88.74/bbl amid renewed demand concerns.

In bond markets:

- The U.S. 10-year Treasury yield dropped sharply by 12 basis points to 4.24%, reflecting a flight to safety.

In currencies:

- The U.S. Dollar Index (DXY) fell -0.4% to 104.15 as traders bet on potential Fed easing later this year.

Notable stock movers:

- Bank of America (BAC) — down -3.2%.

- Caterpillar (CAT) — down -4.1%.

- Nvidia (NVDA) — down -2.9%.

Analysis

The weaker-than-expected GDP number sends a clear signal that the U.S. economy is finally feeling the drag from higher interest rates and tighter financial conditions.

Breaking down the report:

- Consumer spending, which accounts for about 70% of U.S. GDP, rose by just 1.2% compared to 2.5% in Q4 2024.

- Business investment contracted by -0.5%, with declines particularly sharp in equipment and structures.

- Residential investment surprisingly ticked higher (+2.3%), but this was offset by a large -1.8% drop in government spending.

- Net exports subtracted 0.4% from overall growth.

Today’s data suggests that not only has the consumer cooled, but businesses are also pulling back capital expenditures — a worrying sign for future hiring and economic momentum.

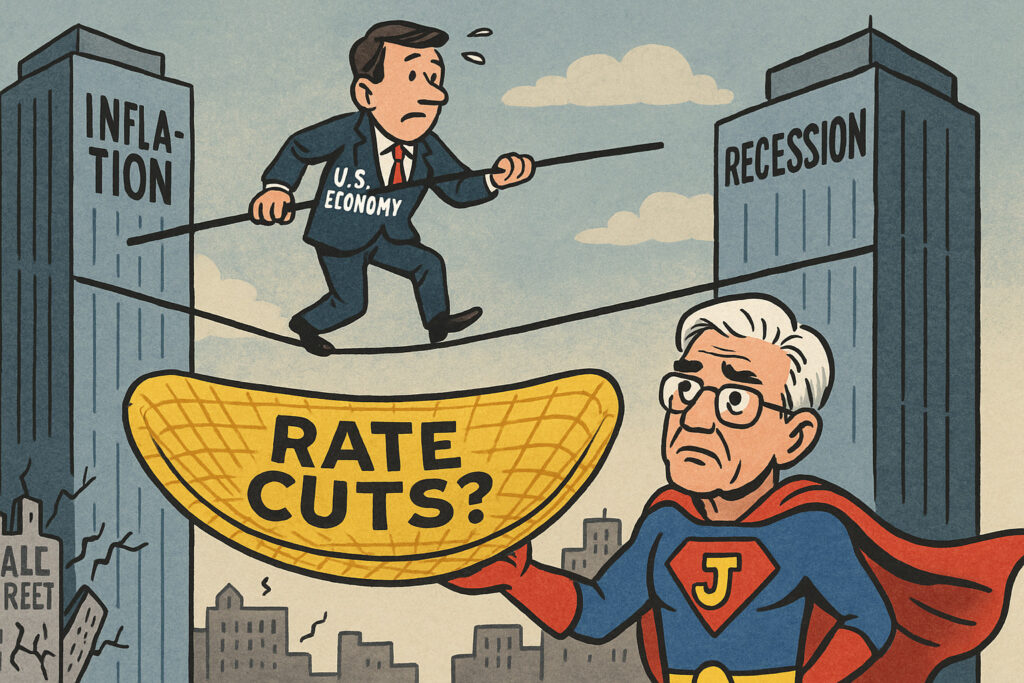

From a policy perspective, the Fed now faces a challenging conundrum. While inflation remains above its 2% target, today’s GDP figures add to arguments that monetary policy is “too tight.” Some market participants are even beginning to price in a rate cut as early as September 2025.

Fed Funds Futures now imply a 56% chance of a September rate cut, up from 38% just yesterday.

However, not all is doom and gloom. The labor market remains historically strong, and service sector activity continues to grow, suggesting the economy is slowing rather than crashing. Nonetheless, today’s numbers heighten the risks of a “hard landing” scenario if policymakers are not careful.

Short-Term Outlook

Over the next week, markets will turn their attention to several key data points and events:

- April Consumer Confidence data (April 30).

- Personal Consumption Expenditures (PCE) Price Index (May 1) — the Fed’s preferred inflation gauge.

- FOMC Meeting and Press Conference (May 1).

Volatility is likely to remain elevated as investors digest the implications of today’s data and position ahead of the Fed’s decision. Bond yields could continue to drift lower if incoming data confirms the slowdown, while equity markets may see defensive sectors (like utilities and consumer staples) outperform.

Key risks include:

- A hawkish Fed tone despite slowing growth.

- Escalation of geopolitical tensions.

- Signs of deeper consumer retrenchment.

Conclusion

Today’s sharp deceleration in U.S. GDP growth is a wake-up call for markets that had been pricing in a soft landing with few bumps. The economic resilience narrative is now facing its toughest test since the rate-hiking cycle began.

While there is still a path to a “softish” landing, much will depend on how quickly inflation moderates and how the Fed responds to today’s weakening growth signals. Investors should brace for more volatility ahead as Wall Street navigates a delicate economic balancing act in the coming months.