Introduction

On 21 August 2025, global financial markets responded with caution following a flurry of pivotal developments. U.S. and European leaders formalized a new trade and investment pact, raising both hopes and concerns about rising tariffs in certain sectors. Simultaneously, Meta’s surprising decision to pause hiring in its AI division signaled a shift in sentiment around tech investment. Adding to the subdued mood, major U.S. indices extended their decline, marking a fifth consecutive day of losses for the S&P 500. The landscape reflected a delicate balance between diplomatic breakthroughs and mounting investor unease, all under the shadow of the highly anticipated Jackson Hole symposium where Fed Chair Powell is expected to guide future monetary policy.

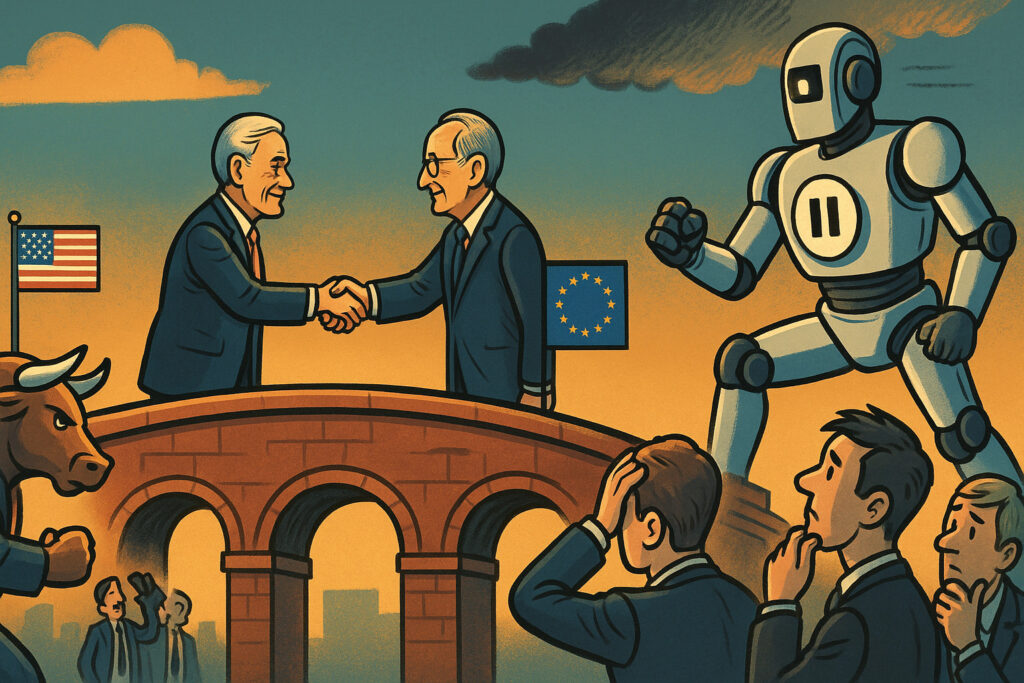

U.S.–EU Trade Accord Marks Mixed Signals

The U.S. and EU concluded a new trade and investment framework aimed at easing industrial tariff barriers and expanding U.S. access to European agriculture and seafood sectors. Yet, this agreement also included commitments to maintain tariffs on select European goods—a detail that elicited mixed interpretations. Investors interpreted the accord as a step toward open dialogue, while also cautioning about lingering protectionist undertones that may sustain pressure on global supply chains and pricing dynamics.

S&P 500 Registers Fifth Straight Loss

In reaction to uncertainty over trade policy and economic direction, U.S. equities slipped once more. The S&P 500 closed lower for a fifth consecutive session—its longest run since January. The Dow and Nasdaq were also starting from a position of weakness amid the S&P’s sustained retreat.

Meta Freezes AI Hiring, Signaling Industry Recalibration

A shockwave ran through tech markets as Meta Platforms announced a hiring freeze in its AI arm, following a rapid hiring spree of over 50 AI experts. This move, presented as organizational recalibration, highlights investor discomfort with unchecked spending and inflated tech valuations—especially in a space where ROI timelines remain uncertain. This cautious turn underscores growing fatigue in the AI investment narrative.

International Markets Show Diverging Sentiments

European equities remained largely flat as trading wrapped for the day. Investors continued to monitor Jackson Hole for signals on monetary policy, especially amid inflationary and geopolitical pressures. Interestingly, the Eurozone’s flash PMI data showed an uptick in new orders, even as defense stocks edged higher in response to ongoing Ukraine peace talks. Meanwhile, in India, markets continued their upward trajectory. Optimism surrounding GST reforms and a favorable macro backdrop reinforced India’s status as a key equity investment opportunity among global strategists.

Fixed Income and Fed Expectations

Strong data from the U.S. manufacturing PMI—the strongest in three years—added complexity to the outlook. This robust report diminished rate-cut expectations, leading yields and the U.S. dollar to edge higher. The Fed’s likely neutral-to-hawkish tone at Jackson Hole may further recalibrate market positioning across rates-sensitive assets.

Investor Sentiment: Defensive with Hesitation

Investor sentiment has cooled, marked by a move toward defensive plays—especially in utilities and consumer staples—even as AI and tech speculative enthusiasm fades. A widening array of voices, including Morningstar analysts, have encouraged diversified and global portfolio structures to navigate lingering volatility. Bonds, long dismissed by some, are gaining renewed respect for their stabilizing potential.

Conclusion

The 21 August 2025 session painted a complex picture: diplomacy and policy reform nudged markets, but structural uncertainty and tech sector recalibration undermined conviction. Trade developments offered both hope and hesitation, while Meta’s AI hiring freeze signaled broader investor apprehension around high-growth narratives.

Looking ahead, Fed Chair Powell’s remarks at Jackson Hole loom as the pivotal catalyst—markets are tracking every nuance for clues about future rate strategy. Equally, investor attention will extend to corporate earnings, tariff implementation details, and macro data for confirmation or disconfirmation of current sentiment.

As markets stand at this intersection of policy, geopolitics, and regulatory recalibration, the path forward may hinge on whether confidence is reinforced—or whether caution continues to define the narrative.