Introduction

The U.S. labor market showed signs of softening in May 2025, as the latest nonfarm payroll report revealed an addition of 139,000 jobs—falling short of consensus estimates around 170,000. At the same time, average hourly earnings rose 3.9% year-on-year, continuing a steady deceleration in wage growth from earlier peaks but remaining above the Federal Reserve’s comfort level for sustained price stability.

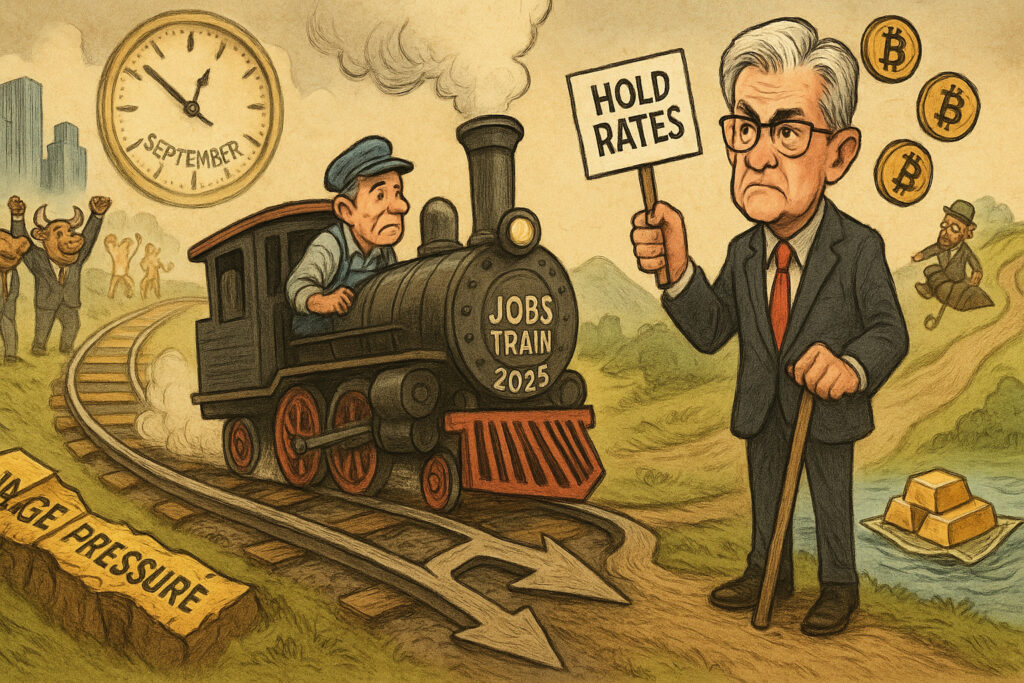

This dual signal—a labor market still expanding but losing momentum, paired with elevated wage pressures—adds nuance to the ongoing monetary policy debate. With the Federal Reserve maintaining a data-dependent stance and markets on edge about the timing of potential rate cuts, this latest jobs report is likely to fuel discussions about the pace and sustainability of economic normalization.

Equity markets responded cautiously to the data, while bond yields drifted lower, suggesting growing investor expectations that the Fed may tilt toward easing later in the year. Here’s a breakdown of the latest labor market data and its implications across major asset classes.

Body

Labor Market Snapshot: A Slowing, Not a Stalling, Engine

The May jobs report offered a mixed portrait of the U.S. employment landscape:

- Nonfarm Payrolls: +139,000 (vs. 170,000 expected)

- Unemployment Rate: 4.0% (up from 3.9% in April)

- Average Hourly Earnings: +0.3% MoM; +3.9% YoY

- Labor Force Participation: Unchanged at 62.7%

The increase in the unemployment rate, reaching 4.0% for the first time since January 2022, reflects a slight increase in labor supply and slower hiring trends in several sectors. Leisure and hospitality, healthcare, and government led job gains, while construction and manufacturing posted modest declines.

While the headline miss in job creation might appear concerning, it’s essential to contextualize this data within the broader macroeconomic trend of normalization following the post-pandemic hiring boom. From an average monthly gain of over 300,000 jobs in 2022 and 2023, employment growth is now returning to pre-pandemic trendlines.

Wage Growth: Sticky, but Easing

The 3.9% year-over-year rise in average hourly earnings, although a modest deceleration from April’s 4.1%, indicates that wage pressures remain persistent. This reading complicates the Fed’s inflation outlook, particularly in service sectors where labor costs are a key input.

Compared to the peak wage growth of 5.9% seen in early 2022, today’s figures suggest meaningful progress. However, inflation-adjusted wages have only recently begun to show sustained real growth, implying that the Federal Reserve may view this level of wage increase as manageable but still above their comfort zone.

Equities: Cautious Optimism

Equity markets responded with guarded optimism to the report. The major U.S. indices ended the day mixed:

- S&P 500: +0.2% to 5,365

- Dow Jones Industrial Average: -0.1% to 38,120

- Nasdaq Composite: +0.5% to 17,290

Investors are increasingly pricing in a “Goldilocks” scenario—where economic growth slows just enough to warrant Fed easing without tipping into recession. The Nasdaq outperformance reflected continued strength in growth and tech stocks, which benefit from lower bond yields and expectations of easier monetary policy.

However, sectors tied to consumer spending and cyclical growth showed signs of hesitation. The consumer discretionary sector was flat, while industrials slipped 0.3%, reflecting concerns about future demand.

Bonds: Yields Ease as Rate Cut Hopes Rise

Bond markets reacted positively to signs of labor market cooling, with yields retreating across the curve:

- 2-Year Treasury Yield: down 7 bps to 4.56%

- 10-Year Treasury Yield: down 9 bps to 4.22%

- 30-Year Treasury Yield: down 6 bps to 4.36%

The yield curve remains modestly inverted, but the degree of inversion narrowed, signaling expectations of future rate cuts. Fed funds futures markets now price in an 80% probability of a 25-basis-point rate cut by September, up from 62% before the jobs report.

This dovish re-pricing reflects not only the jobs data but also recent inflation prints that have trended lower, with April Core PCE inflation easing to 2.8% from 2.9%—still above target, but moving in the right direction.

Currencies: Dollar Dips, Euro Gains

Currency markets saw modest shifts as the dollar weakened slightly against major peers:

- DXY Dollar Index: -0.4% to 103.2

- EUR/USD: +0.5% to 1.091

- USD/JPY: -0.3% to 155.1

The dollar’s decline was driven by lower U.S. yields and a growing consensus that the Fed is closer to easing than the European Central Bank, which has taken a more cautious tone about future cuts after its June 6 meeting. The euro was supported by stronger-than-expected German retail sales data and signs of stabilizing sentiment in the eurozone services sector.

Commodities: Oil Holds, Gold Climbs

Commodities were broadly steady, though gold benefited from lower yields and a weaker dollar:

- WTI Crude Oil: +0.1% to $74.18 per barrel

- Brent Crude: -0.2% to $78.42 per barrel

- Gold: +0.8% to $2,365 per ounce

Oil markets remain focused on OPEC+ guidance and the broader global growth outlook. While the U.S. labor market slowdown suggests weaker domestic demand, global supply concerns—especially surrounding Russian output disruptions—are keeping prices relatively supported.

Gold’s advance was more directly tied to macro drivers: easing yields, rising rate cut expectations, and continued geopolitical uncertainties in Eastern Europe and the Middle East.

Cryptocurrencies: Bitcoin Rebounds on Fed Dovishness

The crypto market, highly sensitive to liquidity expectations, saw renewed interest:

- Bitcoin (BTC): +2.6% to $71,480

- Ethereum (ETH): +2.1% to $3,870

Bitcoin and other digital assets rebounded after a week of sideways action, as the softer jobs report reinforced a more dovish macro narrative. ETF inflows picked up marginally after tapering in late May, with institutional investors cautiously re-engaging amid improving liquidity conditions.

Economic Indicators and Revisions

In addition to the headline employment numbers, several key revisions and supporting data added texture to the report:

- April Payrolls Revised: down to 151,000 from 175,000

- March Payrolls Finalized: at 185,000 (no change)

- U-6 Underemployment Rate: rose to 7.5% from 7.3%

The downward revision to April’s data adds to the narrative that job growth is trending lower than previously believed. The uptick in the U-6 rate, which includes part-time and marginally attached workers, also points to broader labor market slack.

Fed Reaction: Patience or Pivot?

Federal Reserve officials have emphasized their reliance on cumulative data trends rather than single-month figures. Nonetheless, May’s employment data, alongside softening inflation and slowing consumption growth, likely bolsters the case for a cut later this year.

In recent remarks, Fed Chair Jerome Powell reiterated that the central bank is looking for “greater confidence” that inflation is heading sustainably to 2%. While today’s report doesn’t confirm that trajectory, it nudges the Fed closer to that conviction.

Market participants now largely agree that the next policy move is a cut—it’s only a question of when. July remains unlikely barring a sharp deterioration in macro data, but September is increasingly seen as a live meeting.

Sector and Industry Reactions

Sector performance in response to the labor data highlighted shifting investor preferences:

- Technology: +0.7%, with gains in semiconductors and software

- Financials: -0.4%, pressured by lower yields

- Utilities: +0.5%, as rate-sensitive defensives saw renewed buying

- Industrials: -0.3%, amid concerns about cyclical demand

Labor-intensive industries such as retail, food services, and construction are in the spotlight as wage growth remains elevated. Margin pressures in these sectors are likely to persist until wage deceleration becomes more pronounced.

International Context: Global Divergence in Labor Markets

The U.S. employment slowdown contrasts with more mixed global trends. In Europe, unemployment remains stable at 6.4%, but wage growth is slower and inflation pressures are easing more convincingly. In China, job market recovery remains uneven, particularly among youth and service sectors.

This divergence supports the idea that central banks may decouple in their policy paths over the second half of 2025. While the Fed inches toward easing, the ECB and Bank of England remain hesitant, and the Bank of Japan continues to tighten gradually following its exit from negative rates in April.

Conclusion

May’s employment report adds another data point to the evolving macroeconomic puzzle: a gradually cooling labor market with persistent but easing wage pressures. The headline payroll miss and uptick in the unemployment rate suggest that the U.S. economy is slowing but not slipping into contraction.

Markets interpreted the report as dovish, with bond yields falling and equity sectors sensitive to rates showing resilience. The dollar weakened modestly, while gold and cryptocurrencies found fresh bids on expectations of greater monetary accommodation ahead.

For investors, the key question is whether the Fed will feel sufficiently confident to initiate rate cuts as early as September—or whether inflation persistence in wages or services forces a longer wait. The interplay between labor market moderation and inflation outcomes will remain central to that judgment.

As the Fed continues to weigh incoming data, markets will be keenly watching June CPI (due next week) and the next FOMC meeting scheduled for June 18. Until then, the current jobs report sets the stage for a cautious but constructive market tone—one that prices in optimism without overlooking lingering risks.