Introduction

On 28 September 2025, U.S. equity markets ended the week balanced between triumph and tension. After a volatile stretch that saw multiple record highs followed by pullbacks, the major indexes steadied. The S&P 500 hovered close to its recent peak, the Dow Jones Industrial Average held above 46,000, and the Nasdaq Composite remained elevated though less exuberant than earlier in the month.

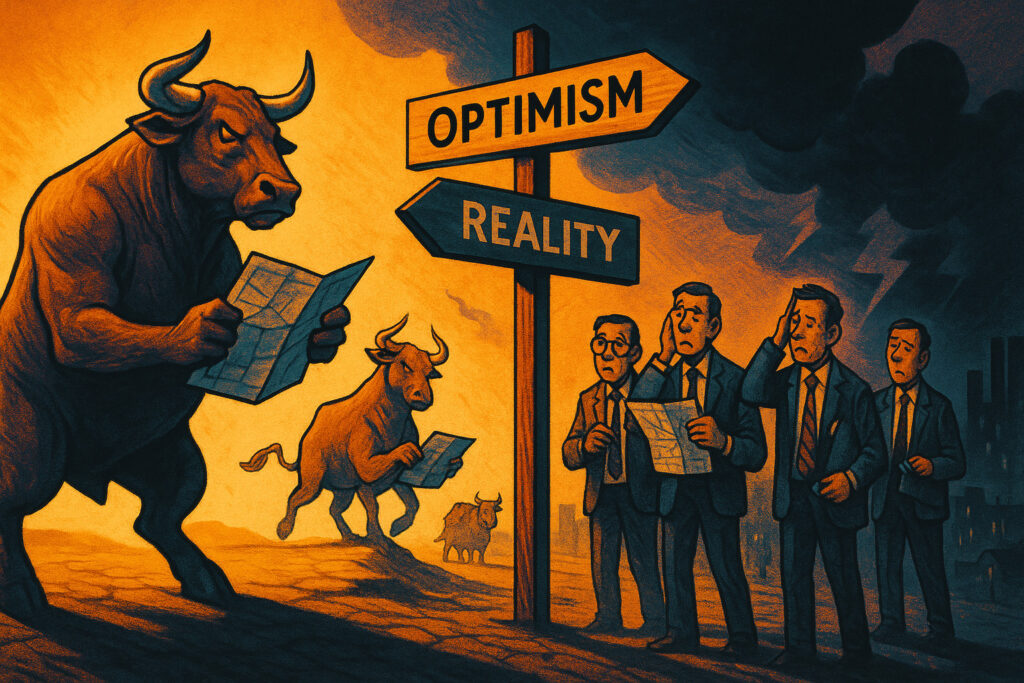

The week’s trading had been shaped by two opposing forces. On one side: the Federal Reserve’s first rate cut of the cycle, a cooling but stabilizing inflation picture, and a market eager to bet on the durability of the bull run. On the other: persistent inflationary pressure, rising bond yields, weakening consumer sentiment, and the looming risk of a government shutdown.

By Saturday, markets had not broken down but had not broken free either. The rally was alive, but questions were multiplying.

Body

Equities: Holding the Line

The S&P 500 ended the week nearly flat, consolidating just shy of all-time highs. The Dow Jones managed a modest weekly gain, while the Nasdaq slipped fractionally, dragged by profit-taking in its biggest technology names.

Small-cap equities, represented by the Russell 2000, were more volatile. They staged a midweek rally but ended lower, reflecting investor caution toward risk-sensitive names amid uncertain liquidity conditions.

Market breadth improved compared to the week’s earlier sell-offs but still lagged the optimism of early September. Investors showed willingness to hold core positions but less conviction in chasing highs.

Sector Dynamics: Balance Over Bravado

- Technology: Still dominant but showing fatigue. Semiconductor names cooled after weeks of relentless gains. AI-linked companies held up, though valuations remain stretched. Mega-cap firms like Alphabet and Microsoft acted as stabilizers rather than growth engines.

- Financials: Banks benefitted modestly from a slightly steeper yield curve, but regional lenders continued to wrestle with commercial real estate exposure.

- Industrials: Supported by infrastructure optimism and steady demand, industrials gained modestly, offering cyclical ballast.

- Energy: Mixed performance, with oil stabilizing around $79 per barrel but failing to break higher. Energy equities moved sideways.

- Consumer sectors: Staples and discretionary showed divergence. Defensive names gained modestly, while discretionary stocks wavered as sentiment data pointed to consumer unease.

- Healthcare: Outperformed slightly, bolstered by defensiveness and merger speculation.

- Real Estate: Struggled with higher discount rates despite brief yield relief earlier in the week.

The pattern was not of exuberant buying but of rebalancing: investors rotating portfolios for stability rather than momentum.

Inflation and the Fed: The Defining Tension

Inflation remained the defining theme of September. Consumer prices rose 2.9% year-over-year in August, with core at 3.1%. While these figures show progress from last year’s peaks, they remain above the Fed’s 2% target.

The Fed’s decision to cut rates by 25 basis points earlier in the month was celebrated by equities but received more cautious interpretation in bonds. Chair Powell’s message that there is “no risk-free path” lingered in investor psychology. Markets are pricing in another cut before year-end, but with uncertainty over whether sticky inflation or labor market resilience will force the Fed into a slower pace.

This tension kept equities from running too far ahead on 28 September. Optimism is tempered by recognition that the Fed must walk a tightrope.

Bonds: Yields Keep Pressure Alive

Treasury yields ended the week higher than many equity bulls would prefer. The 10-year yield closed near 4.1%, while the 2-year held around 4.3%. The yield curve remained compressed, signaling caution.

Bond investors are demanding evidence that inflation will trend lower. Without it, yields are unlikely to provide much relief to equities. The equity rally of September rests on a fragile assumption: that yields will not rise further.

Consumer Sentiment: A Disconnect Grows

Surveys released during the week highlighted a stark disconnect. The University of Michigan’s September sentiment index dropped to 55.1, its lowest level in months. Inflation expectations crept higher, with five-year outlooks near 3.7%–3.9%. Households remain worried about tariffs, prices, and job security.

Wall Street’s records sit uneasily alongside Main Street’s gloom. The divergence raises the risk that weak consumption will eventually feed into corporate earnings, undercutting equity optimism.

Commodities: Stability Without Conviction

Gold held near $3,640 per ounce, consolidating just below recent highs. Demand for the safe-haven metal underscores ongoing hedging behavior.

Oil balanced precariously, with Brent crude anchored at around $79 per barrel. OPEC+ supply discipline prevented declines, but weak demand signals from Asia capped upside.

Commodity markets, like equities, reflected suspension: neither collapsing nor breaking free.

Currency Markets: Dollar Reasserts Itself

The U.S. dollar index regained ground by the end of the week. Higher yields lent strength to the greenback, while the euro weakened on sluggish European growth data. The yen remained under pressure, weighed down by domestic fiscal and political concerns.

Emerging market currencies diverged: exporters of commodities benefitted, while import-dependent economies continued to wrestle with capital outflows.

Currencies provided a sober counterpoint to equities—reminding traders that yield differentials and macro realities still matter.

Global Markets: Following the U.S. Lead

Global equities largely mirrored U.S. indecision. European indices drifted, with modest gains offset by persistent growth worries. Asian equities showed mixed performance: Japan struggled with yen weakness, while China’s markets faced ongoing real estate and industrial challenges. Latin America performed better, supported by commodities.

Global markets reflected the same posture as Wall Street: not collapsing, not soaring, but holding their ground amid uncertainty.

Shutdown Risks and Political Overhang

Adding to the uncertainty was the looming risk of a U.S. government shutdown. With political gridlock unresolved, investors began to price in disruptions to data releases and fiscal clarity. Shutdown fears did not tank markets, but they acted as a cap on enthusiasm.

Shutdowns historically depress GDP growth marginally and raise volatility. This time, with inflation still sticky, the stakes are higher: any disruption could complicate the Fed’s data-dependent stance.

Conclusion

28 September 2025 captured the market at a crossroads. Equities held close to records, supported by faith in the Fed’s pivot and a stabilizing inflation picture. Yet consumer gloom, elevated yields, commodity uncertainty, and political risks weighed on conviction.

The rally is intact—but fragile.

Key Questions Ahead

- Will the Fed deliver another cut in November, or adopt a slower pace in light of inflation persistence?

- Can tech continue to lead without overextension, or will value and defensives take the baton?

- How will consumer weakness translate into earnings as Q4 approaches?

- Can yields remain stable, or will bond markets force equities into another correction?

- Will a government shutdown deepen uncertainty and disrupt market clarity?

28 September 2025 was not a day of records or reversals—it was a day of suspension. A market standing tall, but with shadows lengthening.