Introduction

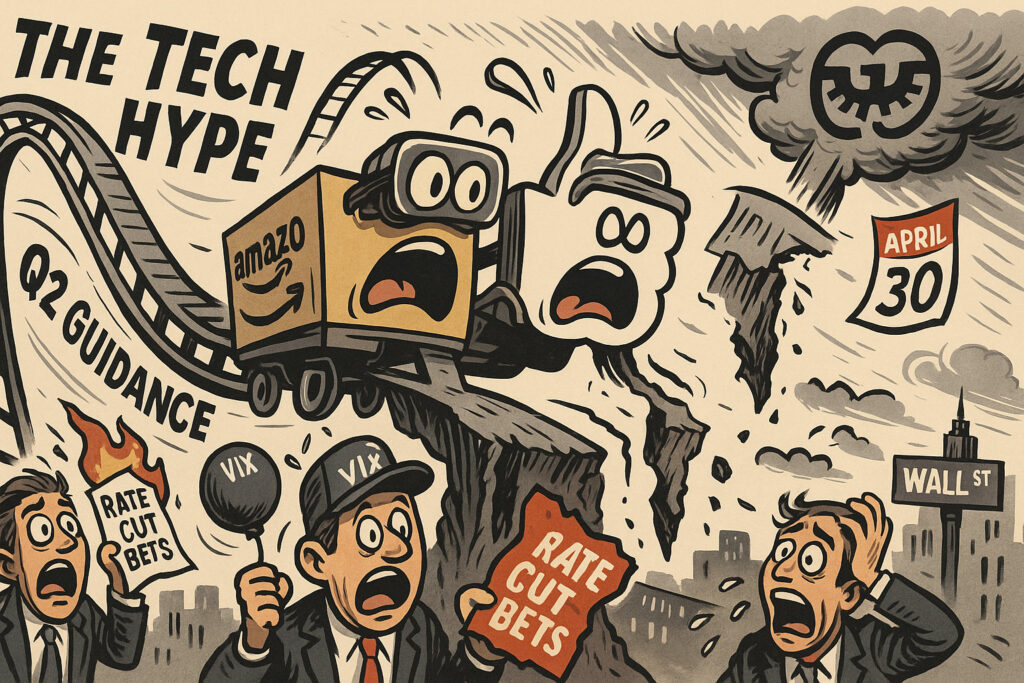

📅 April 30, 2025 — U.S. equities closed sharply lower on the final trading day of April, as a wave of post-earnings selling in megacap tech names triggered a broad market pullback. The S&P 500 dropped 1.8%, the Nasdaq 100 tumbled 2.6%, and the Dow Jones Industrial Average shed 1.3%. The declines were driven by disappointing forward guidance from Amazon and Meta, stoking fears that AI-fueled growth may be plateauing. Treasury yields rose modestly, while gold held steady and oil prices edged higher.

With Wall Street digesting a flurry of corporate earnings, sticky inflation signals, and Fed rate expectations ahead of the May FOMC meeting, the month ended under pressure as risk appetite weakened markedly.

Background

April began on a hopeful note with a tech-led rally, but persistent inflation data and conflicting Fed signals gradually eroded investor confidence. The March Core PCE print, released Friday, came in hotter than expected at 2.9% YoY, reinforcing concerns that inflation is not easing fast enough to justify near-term rate cuts. This added tension to a market already priced for optimism.

Meanwhile, Q1 earnings season delivered robust top-line results across most sectors, yet market reaction skewed negative. Elevated valuations in tech, particularly AI-driven names, raised the bar for earnings surprises — and many failed to clear it. Meta’s earnings last week beat expectations, but cautious commentary on ad spending and AI monetization sent shares down over 11% in a single day. Amazon followed with a similar pattern: strong Q1 results, but soft Q2 outlook.

At the same time, markets grappled with rising bond yields. The 10-year Treasury yield ended Wednesday at 4.74%, its highest since mid-November 2023, reflecting diminished expectations of imminent monetary easing.

Today’s Market Reaction

Major U.S. Indexes – April 30, 2025:

- 📉 S&P 500: 5,088.34 (-1.81%)

- 📉 Nasdaq 100: 17,323.20 (-2.62%)

- 📉 Dow Jones: 37,842.65 (-1.32%)

- 📈 CBOE Volatility Index (VIX): 18.44 (+7.3%)

Mega-Cap Movers:

- 📉 Meta Platforms (META): $374.58 (-4.9%)

- 📉 Amazon (AMZN): $162.12 (-5.4%)

- 📉 Nvidia (NVDA): $844.70 (-3.2%)

- 📉 Microsoft (MSFT): $410.22 (-2.1%)

- 📉 Alphabet (GOOGL): $154.77 (-2.9%)

Commodities:

- 🟩 WTI Crude Oil (June): $84.61 (+1.1%)

- ⬅️ Gold: $2,322.80 (unchanged)

- 🟥 Copper: $4.36/lb (-0.8%)

Currencies:

- 🟩 USD Index (DXY): 105.84 (+0.3%)

- 🟥 EUR/USD: 1.0665 (-0.4%)

- 🟥 USD/JPY: 156.21 (-0.2%)

Bonds:

- 📈 10-year Treasury Yield: 4.74% (+5bps)

- 📈 2-year Treasury Yield: 5.00% (+4bps)

Analysis

April’s final session brought together the two primary forces currently shaping market psychology: earnings fatigue and rate uncertainty.

1. Earnings Disappointment at the Top

Amazon and Meta are emblematic of the current problem for tech: earnings that are “good” are no longer good enough. Both companies exceeded Q1 expectations on revenue and EPS, but issued guidance that suggested a normalization in AI-driven growth rates. For Meta, a slowdown in ad spending and increased Reality Labs losses spooked investors. Amazon’s cloud growth decelerated to 13%, and forward commentary hinted at margin pressures.

These stocks had soared in anticipation of AI monetization and cloud leverage — Meta gained 48% YTD through mid-April, Amazon 37% — leaving little room for any guidance disappointment. The earnings season has served as a stark reminder that lofty valuations require continued operational outperformance.

2. Stubborn Inflation and Fed Hesitation

The March Core PCE deflator, the Fed’s preferred inflation gauge, rose 0.3% MoM and 2.9% YoY, both exceeding forecasts. Services inflation remained particularly sticky, tied to wage pressures and housing costs. This reading came just days before the Fed’s May 1 policy meeting, reinforcing the central bank’s “higher for longer” bias.

Market-implied odds for a July rate cut dropped below 40% from 60% just a week ago, and the 2-year Treasury yield — highly sensitive to Fed expectations — has risen 22 basis points in the past two weeks. In effect, the bond market is now pricing in just one cut in 2025, down from two earlier in the month.

3. Tech Sector Valuation Compression

The price-to-earnings ratios for Big Tech remain stretched even after today’s drop. Nvidia, trading at 36x forward earnings, is still perceived as a proxy for AI enthusiasm. But today’s cross-sectoral selling suggests that institutional investors may be rotating into defensive sectors — utilities, health care, and staples were the only green spots in Wednesday’s session.

4. Macro Crosswinds

Adding to the caution, the Biden administration confirmed new tariffs on select Chinese semiconductor imports, set to take effect in late May. While symbolic, it renewed investor concerns about U.S.-China tech tensions. Furthermore, Friday’s ISM Manufacturing data could provide clues about industrial demand strength — another key macro input.

Short-Term Outlook

Traders are eyeing three key developments in the near term:

- Fed Policy Statement (May 1): While no change is expected, Chair Powell’s press conference could signal whether the recent inflation data delays the start of the easing cycle to September or beyond.

- Jobs Report (May 3): The April Nonfarm Payrolls will be pivotal. A hot print could reignite fears that the Fed may need to tighten further. Conversely, a miss may reinvigorate rate cut hopes.

- Volatility Surge: With VIX back near 18, markets are bracing for larger swings. Options volumes on QQQ and SPY surged today, suggesting increased hedging activity among institutional players.

Additionally, corporate buybacks — which historically provide a cushion during earnings season — appear lighter this quarter, removing a key technical support.

Conclusion

April 30 marked a jarring end to what began as a promising month for Wall Street. With AI enthusiasm colliding with earnings reality, and inflationary pressures clouding the Fed’s path forward, markets have entered a vulnerable phase. The tech-heavy Nasdaq’s near-3% daily drop is a stark reminder that sentiment can shift quickly in a high-valuation environment.

Looking ahead, investor focus is zeroed in on tomorrow’s FOMC decision and Friday’s jobs report — two catalysts that could significantly reshape rate expectations and risk appetite. The market’s narrative is shifting from growth optimism to cautious recalibration, and until inflation convincingly trends down or tech guidance improves, volatility may continue to define the market tone into May.