Introduction

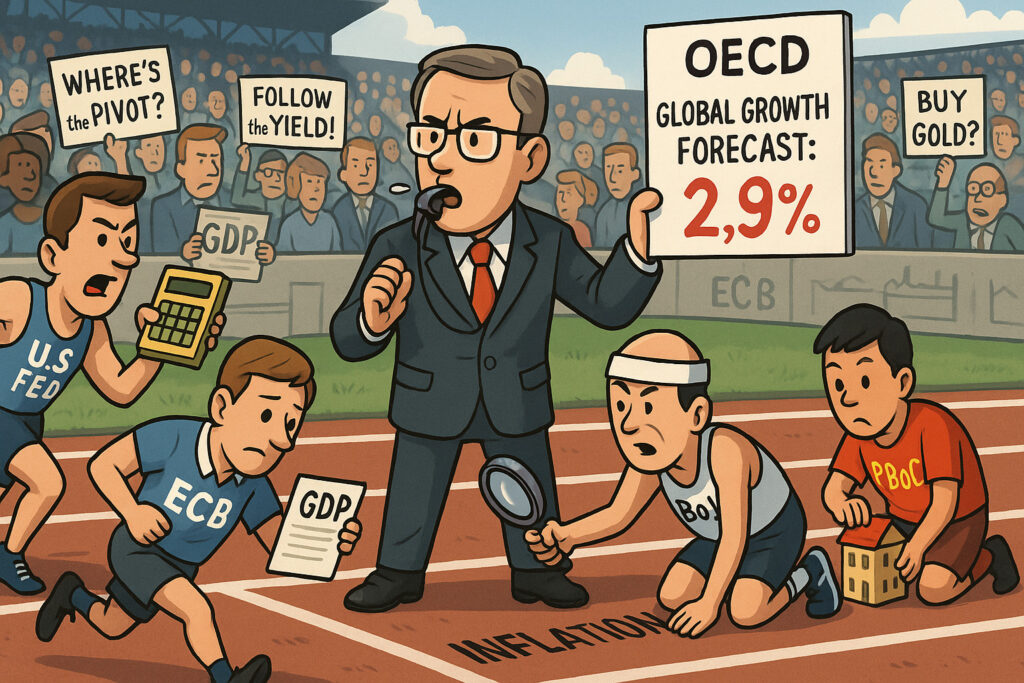

On June 2, 2025, the Organisation for Economic Co-operation and Development (OECD) revised its global economic growth forecast for the year downward to 2.9%, citing persistent policy divergence among major economies, heightened geopolitical uncertainty, and the delayed transmission of tight monetary policy. The adjustment, down from a prior projection of 3.1% in March, signals growing caution about the sustainability of the global recovery amid fractured monetary approaches and uneven post-pandemic structural resilience.

The OECD’s latest semiannual Economic Outlook places emphasis on the differing strategies among central banks—most notably between the U.S. Federal Reserve, European Central Bank (ECB), and Bank of Japan (BoJ)—as a source of volatility and dislocation. While inflation has broadly moderated from 2022–2023 highs, economic momentum has stalled across both advanced and emerging economies, with pockets of resilience clouded by uncertainty in consumer behavior, trade friction, and fiscal policy fatigue.

Markets reacted with a mixed tone. Equities posted modest losses across major indices, sovereign bond yields dipped in developed markets, and currency markets saw renewed volatility, especially in the euro and yen. The OECD’s forecast, widely anticipated by institutional investors, offers a sobering lens through which to assess global capital allocation strategies for the second half of 2025.

Body

OECD Forecast Breakdown: Broad-Based Downgrades

The OECD’s updated outlook paints a cautious macroeconomic picture, revising downward growth expectations for several major economies:

- United States: Growth was revised to 2.2% from 2.4%, reflecting slowing consumption and tighter credit conditions.

- Eurozone: Projected to expand just 0.7%, down from 1.0%, weighed down by weak industrial production in Germany and fragile consumer demand in Italy and France.

- China: Slashed to 4.4% from 4.7%, amid real estate sector weakness and tepid export growth.

- Japan: Cut to 1.0% from 1.2%, as inflation outpaces wage growth, eroding real incomes.

The forecast is particularly notable for emphasizing divergence—not just in GDP trajectories, but in policy response functions. While inflation has cooled globally (OECD average headline CPI projected at 3.2% for 2025), central banks remain hesitant to synchronize on easing due to differing economic structures and fiscal capacities.

Equity Market Reaction: Cautious Sentiment Dominates

Global equity markets ended the day slightly lower. Investors grappled with the implications of a slower global economy and the challenges of allocating capital in an environment with disparate policy signals.

- S&P 500: Fell 0.6% to 5,230, as tech shares led the retreat amid concerns over earnings downgrades linked to softer global demand.

- Stoxx Europe 600: Dropped 0.4% to 505.78, with German industrials and French banks among the laggards.

- Nikkei 225: Slipped 0.7% to 38,950, as the strong yen pressured exporters.

- Shanghai Composite: Closed down 0.9% at 2,935.83, weighed by concerns over a deepening property slowdown.

Notably, defensive sectors such as utilities and consumer staples outperformed, suggesting a risk-off rotation. Global fund flows also indicate a growing preference for short-duration U.S. Treasuries and dividend-paying equities.

Commodities: Oil, Gold Move in Opposite Directions

Commodities reflected the divergence in growth expectations and monetary direction.

- Brent crude: Declined 1.5% to $84.20 per barrel, as weaker OECD demand forecasts and signs of slower Chinese refinery throughput prompted downward revisions in global oil demand growth (now expected at 1.1 million barrels per day for 2025).

- WTI crude: Settled at $80.40, down 1.6%.

- Gold: Rose 1.2% to $2,340 per ounce, boosted by falling yields and safe-haven flows amid concerns about policy fragmentation and geopolitical hotspots in Eastern Europe and the South China Sea.

- Copper: Dropped 2.3% to $9,630/tonne, reversing gains from earlier in May driven by green infrastructure optimism, as industrial orders faltered in the Eurozone.

The commodities reaction underlines the broader uncertainty around demand trajectories, especially as governments pare back fiscal support and consumer savings buffers dwindle.

Currencies: Dollar Strengthens on Relative Growth and Yield Differentials

The foreign exchange market responded with heightened volatility, reflecting relative shifts in monetary policy expectations:

- Dollar Index (DXY): Climbed 0.4% to 105.22, buoyed by safe-haven demand and stronger U.S. real yields.

- EUR/USD: Fell to 1.0702, down 0.5%, as markets priced in a likely ECB rate cut in July.

- USD/JPY: Declined to 153.60, as the yen rebounded on expectations that the BoJ may raise rates again in Q3 to counter inflation.

- GBP/USD: Dipped to 1.2605, as the Bank of England’s recent dovish pivot prompted outflows from sterling-denominated assets.

Emerging market currencies faced renewed pressure, with the South African rand and Turkish lira both down over 1%, amid renewed concerns about dollar liquidity tightening and risk aversion.

Bond Markets: Divergence Drives Yield Compression

Government bonds across developed markets rallied modestly on the OECD downgrade, driven by declining growth expectations and shifting central bank trajectories.

- U.S. 10-Year Treasury Yield: Fell 6 basis points to 4.15%, its lowest in three weeks.

- German 10-Year Bund: Dropped 5 basis points to 2.30%, as eurozone growth pessimism builds.

- Japanese 10-Year JGB: Yield held steady at 1.15%, reflecting market confidence in BoJ’s gradualism.

The yield curve remains inverted in the U.S., with the 2-year yield at 4.43%, suggesting that markets anticipate rate cuts before year-end despite recent hawkish commentary from several Federal Reserve officials.

Bond ETFs attracted net inflows of $3.6 billion in the past week, as institutional investors rotated out of equities and into duration assets in anticipation of easing cycles across Europe and Asia.

Central Bank Policy Paths: Global Divide Widening

One of the OECD’s most salient warnings is the risk posed by asynchronous policy normalization. The report noted that while inflation appears contained, the policy outlook diverges significantly:

- U.S. Federal Reserve: Maintaining a “data-dependent” stance. Futures markets price in a 60% chance of a rate cut by September, although recent PCE data (core PCE at 2.8% YoY) complicates the timing.

- European Central Bank: Markets expect the first cut in July as core inflation dropped to 2.6% in May from 3.0% in April.

- Bank of Japan: Despite achieving its 2% inflation target, real wage stagnation and weak domestic consumption make a rapid normalization unlikely. Yet, policymakers are signaling openness to another rate hike if currency weakness persists.

- People’s Bank of China: Continuing targeted liquidity injections but remains reluctant to cut benchmark rates significantly due to currency stability concerns and capital outflows.

This divergence not only challenges multinational firms and global investors but also risks cross-border financial volatility if the interest rate gap widens further.

Economic Indicators Supporting the Downgrade

Recent global data supports the OECD’s revised outlook:

- U.S. ISM Manufacturing PMI: Slipped to 48.9 in May from 49.5 in April, indicating contraction.

- Eurozone Retail Sales: Fell 0.3% MoM in April, underscoring demand fragility.

- China’s April Industrial Production: Grew just 4.1% YoY, below the consensus of 5.2%.

- Japan Household Spending: Dropped 1.5% YoY in April, a sign of consumer caution despite nominal wage growth.

Taken together, the indicators reflect uneven domestic recoveries and persistent external headwinds from trade fragmentation and supply chain normalization.

Investor Implications: Risks and Scenarios

The OECD’s report leaves investors facing a complex matrix of risks:

- Policy Misalignment: Central bank divergence increases the likelihood of currency volatility, sudden capital flows, and mispricing in global yield curves.

- Earnings Risk: Multinational corporations, particularly those in the tech and industrial sectors, may face downward earnings revisions due to lower global demand.

- Geopolitical Fragility: With elections looming in the U.S., India, and the EU, and ongoing tensions in Ukraine and the South China Sea, policy visibility remains low.

- Liquidity Drain: As fiscal support wanes and quantitative tightening persists in the U.S. and EU, markets may face liquidity constraints, raising volatility in risk assets.

In this environment, asset managers are increasingly favoring barbell strategies: overweighting both high-quality bonds and high-growth equities with strong balance sheets, while reducing mid-cycle cyclical exposure.

Conclusion

The OECD’s decision to cut its global growth forecast to 2.9% for 2025 underscores a fundamental recalibration in global macroeconomic expectations. While the post-pandemic recovery has avoided a hard landing, the momentum is proving elusive and uneven, constrained by policy divergence, lingering inflationary pressures, and growing geopolitical instability.

For investors, the message is clear: capital allocation must account for rising fragmentation and the need for selectivity across regions and asset classes. The days of synchronized global booms appear behind us—for now. In their place, a more fragmented, uncertain, and policy-divided global economy demands nimble strategies and vigilant monitoring.

Key questions remain: Will the Federal Reserve pivot toward easing in time to support U.S. growth without reigniting inflation? Can the ECB cut rates without exacerbating euro weakness? And will China deploy more aggressive stimulus in the face of deteriorating real estate conditions?

In the weeks ahead, central bank communications, earnings guidance revisions, and real-time indicators like PMIs and consumer spending data will prove critical. Amid deceleration and divergence, opportunity still exists—but only for those attuned to the nuances of the global economic inflection now unfolding.