Introduction

After a record-setting nine-day winning streak—the longest for Wall Street since 2004—U.S. equity markets finally faltered on Monday, May 5, 2025. Concerns over resurging protectionist policies and uncertainty surrounding the Federal Reserve’s next move weighed on investor sentiment. The S&P 500 closed the session down 0.6% at 5,202, the Nasdaq Composite fell 0.7% to 16,320, and the Dow Jones Industrial Average slipped 99 points, or 0.2%, to end at 38,790.

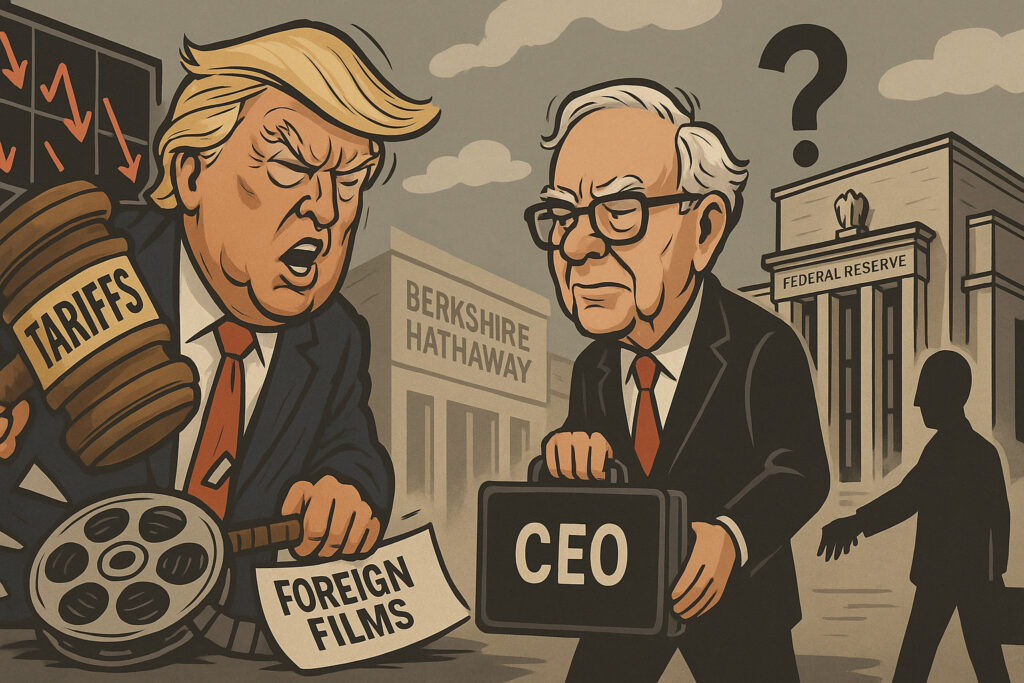

Tariff Shock Rocks Entertainment Stocks

Market jitters intensified after former President Donald Trump, now the presumptive Republican nominee for the 2024 election, reiterated his proposal to impose 100% tariffs on foreign films as part of a broader strategy to “protect American culture.” The unexpected remarks, made during a campaign stop in Pennsylvania, sparked a sharp sell-off in media and entertainment equities. Netflix shares tumbled 1.9% to $578.30, while Paramount Global sank 1.6% to $11.85.

These moves come amid a sector already facing slowing growth and intensifying streaming competition. Analysts noted that the tariff proposal, while not yet policy, revives fears of a global trade war reminiscent of the 2018–2019 standoff, threatening international content distribution pipelines and cross-border investment.

Buffett’s Departure Sends Shockwaves

Adding to the volatility, Berkshire Hathaway (BRK.A) plunged 5.1% to $527,440 after legendary CEO Warren Buffett confirmed he would retire by the end of 2025. In his annual shareholder letter released over the weekend, Buffett expressed confidence in his successors but emphasized the need for a “fresh vision” for the firm’s next chapter.

Investors reacted swiftly, questioning the conglomerate’s future direction and whether Buffett’s strategic clarity and trust can be matched by incoming leadership. Shares of top Berkshire holdings like Apple (-0.8%) and Bank of America (-1.2%) also edged lower on the news.

Bond Yields Rise as Fed Speculation Grows

Investors are also bracing for the Federal Reserve’s May 7 policy meeting. With inflation remaining sticky—March core PCE came in at 3.3%—markets are reassessing expectations that rate cuts could begin as early as June. Yields on 10-year U.S. Treasuries rose to 4.342%, from 4.29% on Friday, while 2-year yields touched 4.89%.

Traders are increasingly split: CME FedWatch now shows a 48% chance of a rate cut in June, down from 65% a week ago. The dollar weakened modestly, with the WSJ Dollar Index slipping 0.2% to 98.71, while gold prices continued to surge, topping $3,310/oz—reflecting safe-haven flows.

Oil Retreats as OPEC Output Rises

Crude oil prices also fell Monday, with Brent down 1.1% to $86.75 per barrel and WTI crude sliding to $82.34, after OPEC+ signaled higher output quotas for June. The adjustment comes as Saudi Arabia and UAE attempt to offset slowing demand growth from Asia, especially China, where holiday closures kept markets muted.

The decline in oil, while easing inflation pressures, dragged down energy stocks: ExxonMobil (-1.3%) and Chevron (-1.1%) led sector losses.

Global Markets Mixed Amid Holiday Closures

European equities posted modest gains, with the Euro Stoxx 50 up 0.3%, aided by better-than-expected German factory orders (+1.7% MoM). However, many Asian markets, including Tokyo and Shanghai, were closed for public holidays, contributing to lighter global trading volumes.

Cryptocurrencies were largely range-bound, with Bitcoin trading around $59,880 and Ethereum holding near $2,940. Traders appear hesitant to take positions ahead of the Fed’s rate decision and ongoing regulatory scrutiny in the U.S.

Conclusion

May 5 marked a turn in recent bullish momentum, as geopolitical noise and leadership transitions returned to the fore. Markets remain fundamentally strong but face renewed volatility as monetary policy uncertainty, political rhetoric, and corporate leadership changes converge.

Investors should prepare for a pivotal week. All eyes are now on Wednesday’s FOMC statement, where even subtle shifts in tone could reset expectations. Until then, volatility is likely to persist, particularly in sensitive sectors like tech, entertainment, and banking.