Introduction

On 22 August 2025, global markets surged as Federal Reserve Chair Jerome Powell delivered a nuanced yet optimistic speech at the Jackson Hole Economic Symposium, hinting at the possibility of interest rate cuts. His remarks around labor market risks and changing inflation dynamics sparked investor enthusiasm, propelling the Dow Jones Industrial Average to a record high and spurring broad-based gains across equities. Meanwhile, sector-specific developments—such as Nvidia’s China-related chip pause, Meta’s new cloud contract, and Intuit’s softened outlook—added texture to an already complex market narrative. The day reflected the delicate interplay between central bank signaling, political undercurrents, and firm-level catalysts in shaping risk appetite.

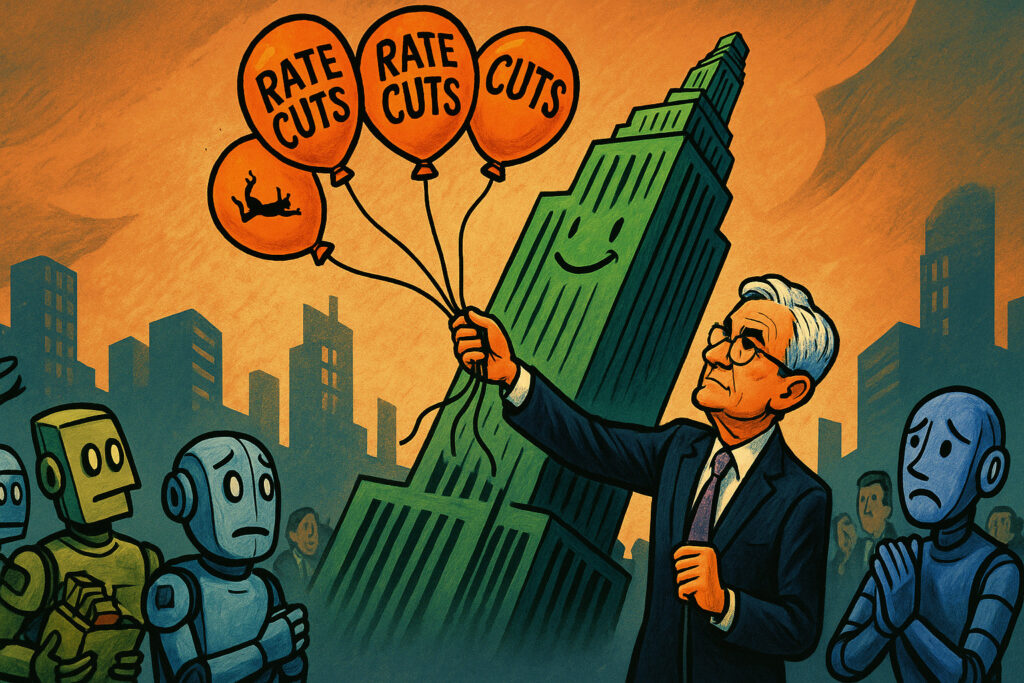

Powell’s Speech Drives Bullish Momentum

Powell’s Jackson Hole address marked a pivotal moment. Acknowledging growing fragility in the labor market, he conveyed that a September rate cut may be warranted, albeit with cautious intent. His remarks sparked broad relief among investors who had feared inflationary pressures from tariffs might delay easing. Markets interpreted his balanced tone—dovish lean, data-dependent follow-through—as supportive of near‑term accommodation. The S&P 500 jumped nearly 2%, while the Dow leaped over 800 points to close at a fresh all-time high. Bonds rallied substantially, with Treasury yields plunging, and the U.S. dollar weakened in response.

Despite the optimism, some voices cautioned that Powell remains cognizant of inflation risks—particularly those linked to tariffs—and may temper promises with guarded language. A wedge exists between market expectations and Powell’s careful framing, leaving room for volatility if data or rhetoric shift.

Tech and Corporate Moves Add Complexity

Amid the Fed drama, major corporate developments added layers to investor sentiment:

- Nvidia reportedly suspended production of its H20 chip intended for China, following Beijing’s security concerns—even after controversial U.S. approval conditioned on revenue-sharing. The move rattled GPU supply chains and cloud infrastructure narratives.

- Meta inked a landmark $10 billion cloud services deal with Google, adding to its arrangements with Microsoft and AWS—highlighting its deepening AI infrastructure ambitions.

- Intuit shares pulled back roughly 6.5%, despite strong Q4 results, after issuing weaker-than-expected guidance—underscoring that solid earnings don’t always equate with forward momentum.

These stories illustrate the bifurcated nature of tech investor sentiment: excitement in infrastructure and AI, caution in consumer-oriented forecasting, and anxiety around geopolitical constraints.

Broader Equities and Sector Rotation

Across broader markets, momentum extended beyond blue chips:

- The Russell 2000 surged nearly 3.9%, as small and mid-caps rallied alongside optimism for lower interest rates.

- Sectors like homebuilders and travel—sensitive to consumer activity and rates—posted gains, levered to rising confidence in consumption and financing conditions.

- Asian markets rose, and European indices like Germany’s DAX++ advanced—reflecting global investor alignment and spillover from U.S. central bank optimism.

Commodities, Crypto, and Fixed Income

Commodities and alternative assets responded with mixed signals:

- Oil prices rose modestly, buoyed by easing growth concerns and reduced bond yields.

- Gold prices declined, reflecting the rotation out of safe-havens as risk-on sentiment returned.

- Bitcoin, after a significant pullback over August (~8%), edged slightly higher—suggesting stabilization amid renewed macro risk appetite.

The Fed’s Tightrope and Political Crosswinds

Powell’s signal for a careful path to easing comes amid elevated political pressure and policy volatility. Trump’s vocal calls for Fed rate cuts and interference in hiring at economic institutions heighten uncertainty around central bank independence. Powell reaffirmed a commitment to data-driven policy despite these tensions.

Meanwhile, the complex backdrop of tariff-driven inflation—often sticky and unpredictable—complicates the Fed’s flexibility. While Powell’s speech offered a bridge between caution and optimism, its impact hinges on upcoming economic data and political machinations.

Conclusion

The 22 August 2025 market episode captured a moment of realignment: Powell’s speech injected renewed optimism, equity markets responded with lofted valuations, and sectors from tech to small-caps recalibrated to a more accommodative outlook. Yet, the path forward remains finely balanced—hinging on evolving data, geopolitical undercurrents, and the Fed’s resolve to temper exuberance with prudence.

Key questions for investors remain:

- Will incoming inflation or labor data strengthen rate-cut expectations—or dampen them?

- Can Powell navigate political pressures while preserving credibility and independence?

- Will tech and AI continue to lead—or will ESG, infra, and small-cap rotations dominate the next phase?

Ultimately, the record-setting gains of August 22 symbolize both triumph and fragility: markets embrace optimism rooted in hope, yet remain conscious of the complexity ahead.