Introduction

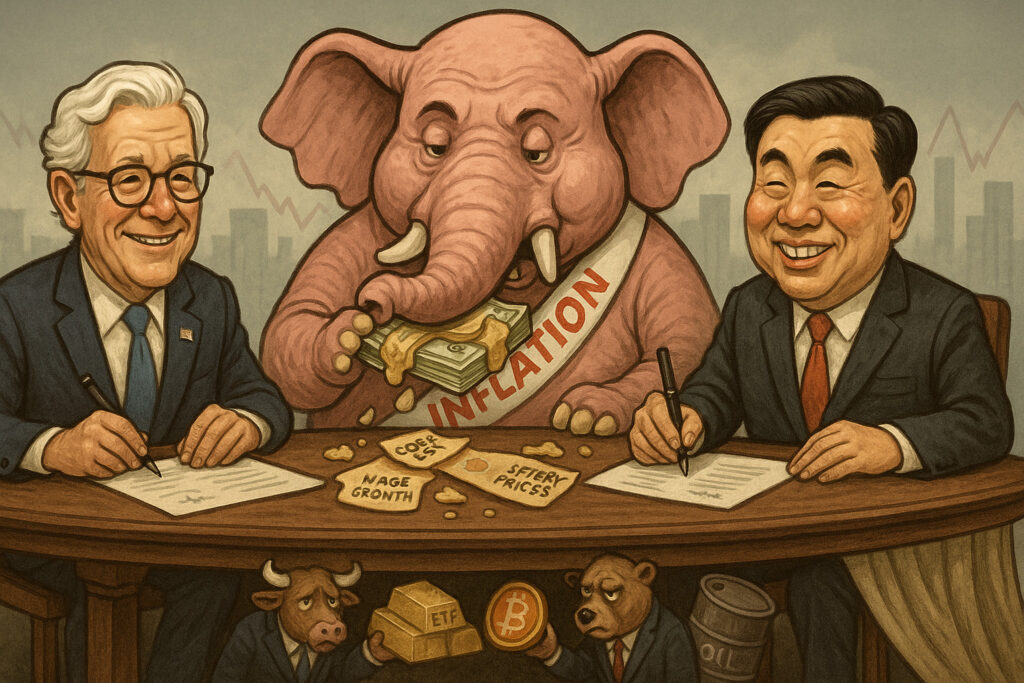

On May 11, 2025, global financial markets experienced a notable upswing, driven by renewed optimism surrounding U.S.-China trade negotiations. Over the weekend, high-level discussions between U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng signaled a potential de-escalation in the ongoing trade tensions between the world’s two largest economies. While specific details remain scarce, the positive tone of the talks has buoyed investor sentiment. However, this optimism is tempered by persistent inflationary pressures and uncertainties regarding the Federal Reserve’s monetary policy trajectory.

U.S.-China Trade Talks: A Glimmer of Hope

The recent trade discussions mark a significant shift from the heightened tensions that characterized earlier months. In April, the U.S. imposed a sweeping 145% tariff on Chinese imports, prompting retaliatory measures from China. These actions contributed to market volatility and investor apprehension. The latest talks, described as “candid and constructive,” suggest a mutual willingness to find common ground and potentially roll back some of the more punitive measures.

Market reactions were swift. Futures for the Dow Jones Industrial Average surged over 530 points (1.3%), while the S&P 500 and Nasdaq futures rose by 1.4% and 1.6%, respectively. This rally reflects investor hopes that a resolution to the trade dispute could alleviate some of the economic headwinds facing global markets.

Inflation Remains a Stubborn Challenge

Despite the positive developments on the trade front, inflation continues to pose challenges. The U.S. Consumer Price Index (CPI) remains elevated, with the latest data indicating a year-over-year increase of 4.9%. Core inflation, which excludes volatile food and energy prices, also remains above the Federal Reserve’s 2% target.

This persistent inflation complicates the Fed’s policy decisions. While some market participants anticipate potential rate cuts to support economic growth, the central bank remains cautious. The Fed’s projections suggest a federal funds rate of 3.4% by the end of 2025, indicating a measured approach to monetary easing.

Market Performance and Sector Highlights

The optimism stemming from trade negotiations has provided a boost to various sectors:

- Technology: The Invesco QQQ Trust Series 1 (QQQ) saw a modest increase, reflecting renewed confidence in tech stocks that are sensitive to trade dynamics.

- Energy: The United States Oil Fund (USO) experienced gains, as easing trade tensions could lead to increased industrial activity and energy demand.

- Precious Metals: The SPDR Gold Shares ETF (GLD) remained relatively stable, as investors balanced risk-on sentiment with the safe-haven appeal of gold amid inflation concerns.

- Cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH) displayed minor fluctuations, with BTC trading around $103,850 and ETH at approximately $2,502. These assets continue to be influenced by broader macroeconomic factors and regulatory developments.

Global Implications and Investor Sentiment

The potential thawing of U.S.-China trade relations has global ramifications. Improved bilateral ties could stabilize supply chains, reduce input costs, and foster a more favorable environment for international trade. However, the lack of concrete agreements and the ongoing challenges posed by inflation mean that markets remain susceptible to volatility.

Investor sentiment, while improved, is cautious. The Cboe Volatility Index (VIX) remains elevated, indicating that market participants are bracing for potential fluctuations. Analysts advise maintaining diversified portfolios and closely monitoring economic indicators and policy announcements.

Conclusion

The recent U.S.-China trade talks have injected a dose of optimism into global markets, offering the prospect of reduced tensions and improved economic cooperation. However, persistent inflation and uncertainties surrounding monetary policy continue to cast a shadow over the economic outlook. Investors are advised to stay informed and agile, as the interplay between geopolitical developments and economic indicators will shape market trajectories in the coming months.