Introduction

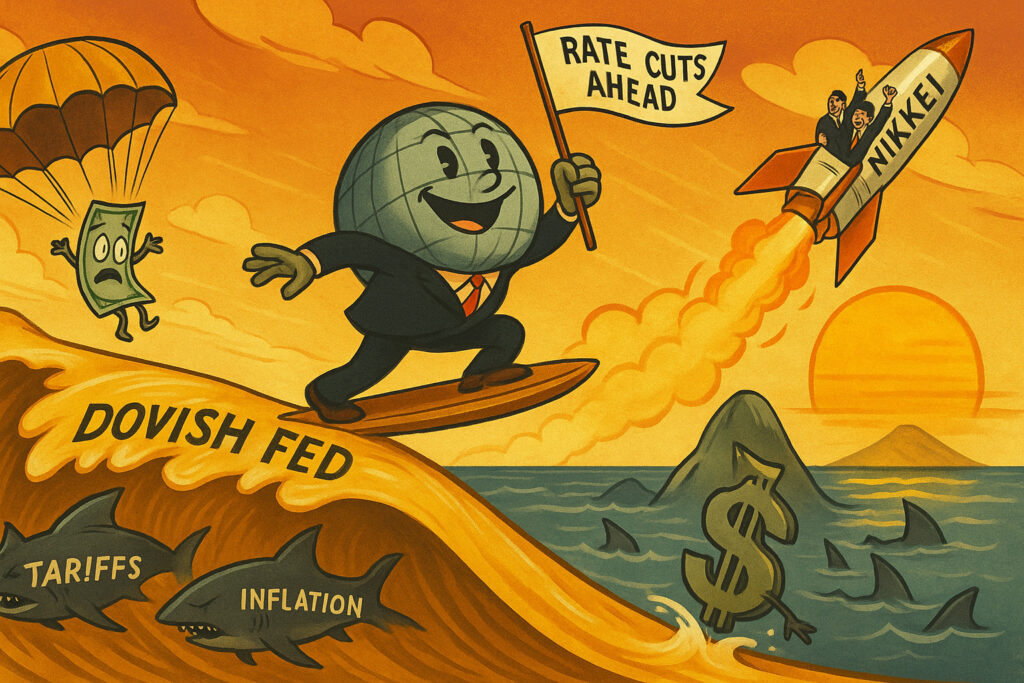

On August 8, 2025, financial markets experienced a broad rally, propelled by mounting expectations of imminent U.S. interest rate cuts, robust Japanese earnings, and easing trade concerns. The U.S. Federal Reserve saw a leadership shake-up with a short-term appointment expected to tilt policy toward dovishness—a move that sent stock futures higher and rekindled investor optimism. Meanwhile, Japan’s equity markets delivered stellar gains as key exporters received relief from tariff rule adjustments, bolstering confidence across the region. Safe-haven assets, particularly gold, reached fresh price peaks, underscoring persistent geopolitical and economic uncertainty. This article examines the multi-asset market dynamics of the day, explores policy shifts, and assesses the implications for investors heading into the second half of 2025.

Body

Federal Reserve Shake-Up Spurs Easing Expectations

The biggest market driver was the unexpected shift in U.S. central bank leadership, as a new appointee aligned with dovish policymaking signaled a likely pivot toward rate cuts. Futures across major U.S. indices climbed in response, reflecting elevated investor confidence in easing monetary policy. Projections now show a high probability of a rate cut as soon as next month, with further cumulative reductions expected by year-end. This has reshaped the interest rate outlook, putting pressure on long-duration assets and emboldening equity valuations.

Tech Stocks and Sector Divergence

Technology firms received a boost as the dovish Fed outlook alleviated fears of policy tightening. Speculation that chipmakers could sidestep some tariff burdens by increasing domestic production led to a surge in semiconductor-related equities. Yet, not all sectors participated equally. Healthcare and ad tech stumbled amid disappointing earnings from several large-cap players, creating a notable divergence between market winners and laggards.

Japanese Markets Soar on Earnings and Trade Relief

Asia displayed a mixed performance, but Tokyo stood out as the top regional performer. Japan’s stock market rallied sharply, with key indices hitting fresh records. Gains were buoyed by strong corporate earnings and relief on trade frictions, particularly around semiconductor exports. Top-tier technology and convergence names led the charge, supported by optimism around resumption of U.S.-Japan trade normalcy and favorable investment sentiment.

Asian Contrast: Uneven Regional Performance

While Japan thrived, markets elsewhere in Asia treaded cautiously. Mainland Chinese, Hong Kong, South Korean, and Australian indexes posted losses, weighed down by broader uncertainty around global monetary policy and China’s growth trajectory. Emerging market equities, more vulnerable to global shocks, underperformed relative to core Asian and Western benchmarks.

Gold Prices Climb to Unprecedented Levels

Amid the swirl of geopolitical and economic uncertainty, gold futures surged, setting new record highs as investors sought refuge from policy risks and tariff-driven volatility. The spike in gold further reflected global concerns over trade escalation and the potential inflationary impact of protectionist measures.

Oil Market Softness Reflects Easing Geopolitical Pressures

Crude oil prices dipped modestly. Investors interpreted signals of easing sanctions and potential diplomatic thaw with key geopolitical players as mitigating near-term supply risk, reducing the appeal of energy as an inflation hedge. The overall tone in commodity markets suggested a cautious but improving outlook for global demand.

Emerging Markets and Currency Dynamics

Emerging markets remained subdued, grappling with continued trade war risks and the fragility of global investor sentiment. In currency markets, the U.S. dollar exhibited mild strength against the yen, while showing signs of weakening against the euro—indicating complex cross-currents between policy expectations and regional central bank divergences.

Central Bank Divergence and Global Liquidity

Monetary divergence became more apparent, with global liquidity expanding as central banks outside the U.S. continued easing or signaling readiness to support growth. Analysts highlighted that over twenty central banks have already eased policy this year, contributing to an environment conducive to equity outperformance and bond rallying.

Market Commentary and Investor Sentiment

Investors embraced the dovish shift but remained cautious. Liquidity-driven optimism was tempered by lingering inflation concerns and geopolitical flashpoints. Portfolio rotations favored defensive and cyclical sectors best positioned to benefit from rate cuts, while volatility measures remained elevated across asset classes.

Conclusion

August 8, 2025, delivered a powerful validation of how policy change, earnings surprises, and trade metrics can rapidly realign market sentiment. Key takeaways for investors include:

- The Fed’s leadership move has crystallized expectations for upcoming rate cuts, bolstering risk-taking and equity valuations.

- Japanese equities surged on strong fundamentals and eased trade constraints, offering a clear regional outperformer.

- Gold’s record highs signal enduring uncertainty, even amid dovish policy trajectories.

- Oil’s modest dip reflects transient geopolitical calm, but sustainability depends on broader diplomatic developments.

- Divergent central bank paths and persistent trade risk keep volatility alive, despite pockets of expansionary momentum.

Looking ahead, critical questions include:

- Will the Fed follow through with confirmed easing, and how will bond markets respond?

- Can Japanese and global exporters capitalize on reduced trade friction, or will protectionist pressures resurface?

- Will gold remain elevated, or will easing inflation expectations temper its appeal?

- How will emerging markets navigate these shifting currents, especially those reliant on external funding and trade flows?

As investors digest these developments, balancing opportunistic exposure with prudent hedging remains essential. The path forward will hinge on central bank messaging, trade developments, and the resilience of corporate earnings across regions.