Introduction

On May 10, 2025, global financial markets exhibited a cautious stance as investors awaited the outcome of high-stakes U.S.-China trade negotiations and the release of key inflation data. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all showed minimal movement, reflecting the market’s uncertainty. This article delves into the day’s market dynamics, the factors influencing investor sentiment, and the potential implications for various asset classes.

Market Overview

Equity Markets

U.S. equity markets closed the week with slight losses, as investors remained on the sidelines ahead of significant economic events.

- S&P 500 (SPY): Closed at $564.59, down 0.08% from the previous close.

- Dow Jones Industrial Average (DIA): Ended at $412.42, a marginal decrease of 0.06%.

- Nasdaq Composite (QQQ): Finished at $487.97, up 0.28%.

The muted performance indicates investor hesitation, with market participants awaiting clarity on trade policies and inflation trends.

Fixed Income

The bond market remained relatively stable, with the iShares 20+ Year Treasury Bond ETF (TLT) closing at $87.21, down 0.07%. Yields held steady as traders anticipated upcoming inflation data that could influence Federal Reserve policy decisions.

Commodities

- Gold (GLD): Closed at $306.82, down 0.27%.

- Oil (USO): Finished at $66.61, up 0.50%.

Gold prices dipped slightly as the dollar strengthened, while oil prices rose on expectations of increased demand and potential supply constraints.

Cryptocurrencies

- Bitcoin (BTC): Traded at $103,604, up 0.59%.

- Ethereum (ETH): Stood at $2,416.71, gaining 3.04%.

Cryptocurrencies experienced modest gains, with Ethereum outperforming Bitcoin, possibly due to growing interest in decentralized finance applications.

Key Drivers of Market Sentiment

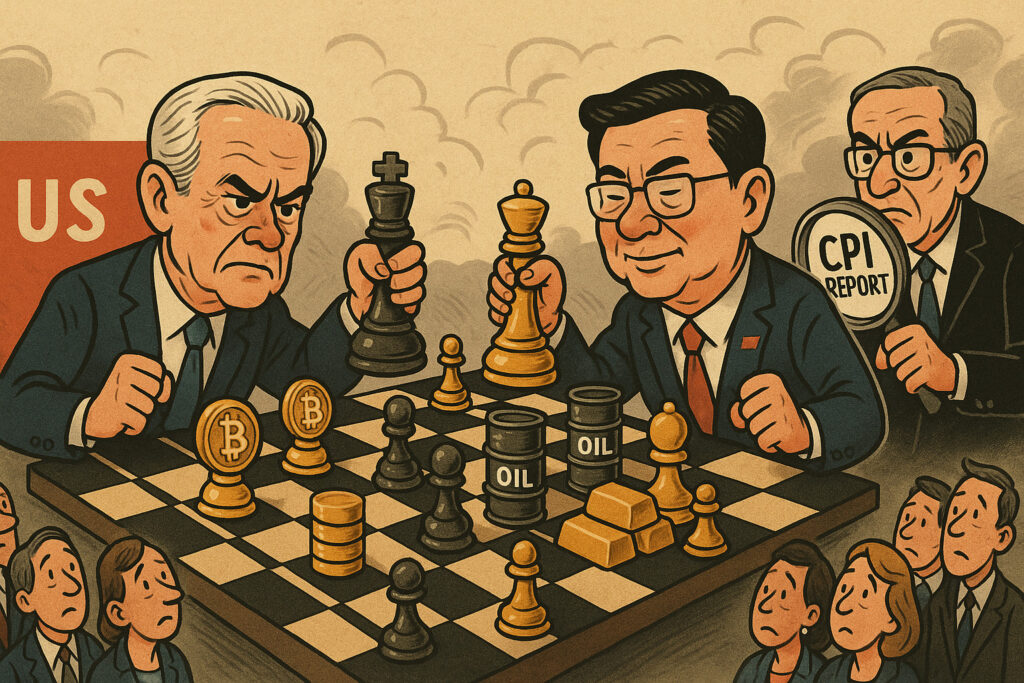

U.S.-China Trade Talks

Investors closely monitored developments in the ongoing trade negotiations between the United States and China. The anticipation of potential tariff reductions and improved trade relations contributed to market stability. However, the lack of concrete outcomes kept investors cautious.

Inflation Data Anticipation

The market’s focus shifted towards the upcoming release of Consumer Price Index (CPI) data, scheduled for next week. Analysts predict that the inflation figures will provide insights into the Federal Reserve’s future monetary policy actions. A higher-than-expected CPI could prompt the Fed to consider tightening measures, impacting equity and bond markets.

Sector Performance

Technology

The technology sector showed resilience, with the Nasdaq Composite posting a modest gain. Investors continued to favor tech stocks, driven by optimism around innovation and growth prospects.

Energy

Energy stocks benefited from rising oil prices, as the United States Oil Fund (USO) gained 0.50%. Expectations of increased demand and potential supply disruptions supported the sector’s performance.

Financials

Financial stocks remained flat, reflecting the broader market’s cautious sentiment. Investors awaited inflation data that could influence interest rates and, consequently, financial sector profitability.

Global Market Implications

The outcome of the U.S.-China trade talks holds significant implications for global markets. A positive resolution could boost investor confidence, leading to increased risk appetite and higher equity prices worldwide. Conversely, a breakdown in negotiations may trigger market volatility and a flight to safe-haven assets.

Conclusion

May 10, 2025, was characterized by market caution as investors awaited critical developments in trade negotiations and inflation data. The subdued market movements reflect the uncertainty surrounding these events. As the new week approaches, market participants will closely analyze the outcomes of the U.S.-China trade talks and the CPI release to gauge future market directions.