Introduction

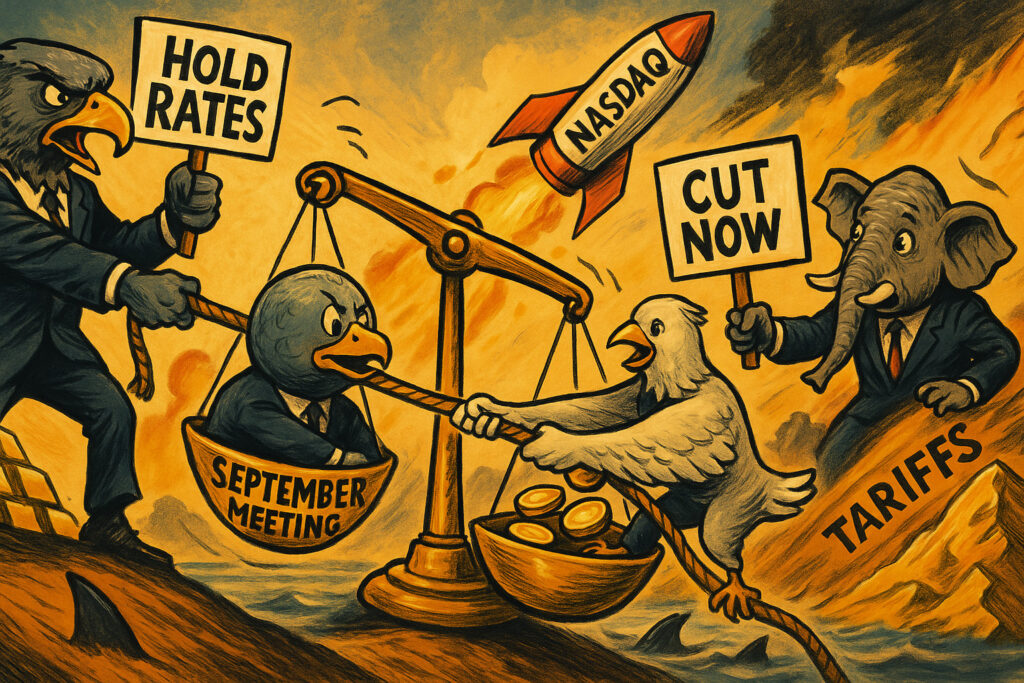

On August 9, 2025, global markets entered a phase of cautious reevaluation, fueled by renewed dovish whispers from the U.S. Federal Reserve and stretched valuations in Asian assets. Fed Governor Michelle Bowman’s public support for a September-rate cut signaled growing momentum toward policy loosening, recalibrating interest rate expectations. U.S. equities finished the previous session at or near record highs, spotlighting the Nasdaq’s resilience amid tech optimism. Simultaneously, Indian equity benchmarks slipped under pressure from weakening external sentiment, institutional outflows, and the specter of heightened tariffs.

Meanwhile, benchmark oil prices surged this week, and gold continued to command safe-haven flows amid uncertainty. Markets now await the U.S. consumer price index report due next week—a key test for the current rally. This article dissects the day’s driver themes across asset classes and geographies, evaluates the move in policy pivots, and assesses what lies ahead as markets navigate the remainder of August.

Federal Reserve Divergence Accelerates

Fed Governor Martha Bowman’s remarks on Friday crystallized a shift in tone from the U.S. central bank. By explicitly endorsing a September-rate cut and hinting at three cuts by year-end, she broke from the more cautious tone of Chair Powell and others. Bowman’s advocacy reflects mounting concern over labor market softness, potentially paving the way for early easing. Markets swiftly priced in at least one rate cut by September and a growing possibility of multiple adjustments before year-end.

This divergence highlights the increasing fissure within Fed policymaking, with formerly restrained members moving toward a more accommodative stance. If formalized, this change in direction could support further rallies in rate-sensitive sectors and longer-duration assets—particularly equities and credit—while putting additional downward pressure on Treasury yields globally.

U.S. Equity Momentum Remains Intact

Friday’s data spotlighted a resilient U.S. equity landscape. The Nasdaq notched another record closing high, bolstered by strength in tech and AI-related sectors. Meanwhile, the S&P 500 narrowly missed record territory, while the Dow posted solid gains for the week—driven by better-than-expected corporate updates and optimism around Fed accommodation. Market breadth remained favorable, with advancing issues outnumbering decliners across NYSE and major indices.

Despite pockets of sectoral weakness, such as healthcare and cybersecurity earlier in the week, risk appetite remains elevated. The continued strength in U.S. equities demonstrates that investor focus remains tilted toward the benefits of easier financial conditions and sustained corporate resiliency.

India Faces Equity Setbacks

Indian markets wavered notably this week as international funds gradually pulled back exposure amid growing macro uncertainty. The benchmark Nifty 50 fell below the psychologically important 24,400 level, closing around 24,360, and the Sensex declined similarly.

The pullback was driven by multiple pressures: subdued global cues, doubling of tariff threats, persistent concerns over earnings growth, and sustained foreign institutional outflows. Defensive sectors such as pharmaceuticals and autos showed relative resilience, while IT names struggled. With mild technical deterioration appearing in derivatives data and August trends historically mixed, investor sentiment remains fragile. Key levels for Bank Nifty and other benchmarks will be closely monitored in coming weeks.

Commodities: Oil Rises, Gold Steady

In commodity markets, crude oil posted weekly gains, with Brent finishing near $79.70 and WTI edging up toward $76.80. The rebound reflected improved demand expectations, easing Middle East tensions, and expectations of stabilizing global growth.

Gold continues to hold near record highs, reflecting underlying geopolitical and inflation uncertainty. The precious metal remains a clear beneficiary of dovish policy expectations and persistent uncertainty around protectionism and central bank divergence.

Bond Markets and Financial Conditions

Treasury yields declined further as markets digested dovish Fed rhetoric, with the yield curve steepening modestly—signaling renewed confidence in growth and easing expectations. U.S. 10-year yields tested lower bounds, while short-dated maturities continued to front-run easing in rate-sensitive sectors.

In this environment, credit spreads continued to compress, supported by strong demand for income and attractive valuations. Speculative-grade bonds saw inflows, and ETFs tracking both high yield and investment-grade segments benefitted from improving sentiment.

Cautious Sentiment as Inflation Report Looms

Looking ahead, markets await the U.S. consumer price index release. Investors are balancing growing confidence in rate cuts against the risk of inflationary rebound. Should inflation undershoot, expectations may shift further dovish; if surprises emerge, the rally could pause or reverse.

Emerging markets remain vulnerable to this uncertainty. Currencies like the Indian rupee and Indonesian rupiah remain under pressure, while regional equity indices may attempt to stabilize if inflation and policy clarity materialize in the coming days.

Conclusion

August 9, 2025 painted a picture of diverging central bank signals and bifurcated asset class performance:

- The Fed’s internal rift widened as Governor Bowman embraced imminent easing—potentially setting the stage for September action.

- U.S. equities held firm, with tech and macro-driven sectors benefiting most from dovish repricing.

- Indian markets lagged amid capital outflows and tariff anxieties, marking a regional contrast to global strength.

- Commodities painted mixed signals: crude improved on demand hopes, while gold remained elevated on policy uncertainty.

- Fixed income rallied, realigning yields lower and reinforcing easing expectations.

- All eyes now turn to the U.S. CPI report, which may determine whether the current rally extends or falters.

Key questions remain:

- Will the Fed formalize its dovish tilt at the September meeting?

- Can global equities maintain momentum amid policy divergence and geopolitical flux?

- Will emerging markets like India regain footing, or will outflows persist?

- How will bonds and credit markets reposition if inflation surprises either way?

As August unfolds, investors must remain alert to the interplay between central bank moves, data dynamics, and global capital flows. Strategic flexibility and a keen eye on the policy-data nexus will be crucial in navigating what lies ahead.