Introduction

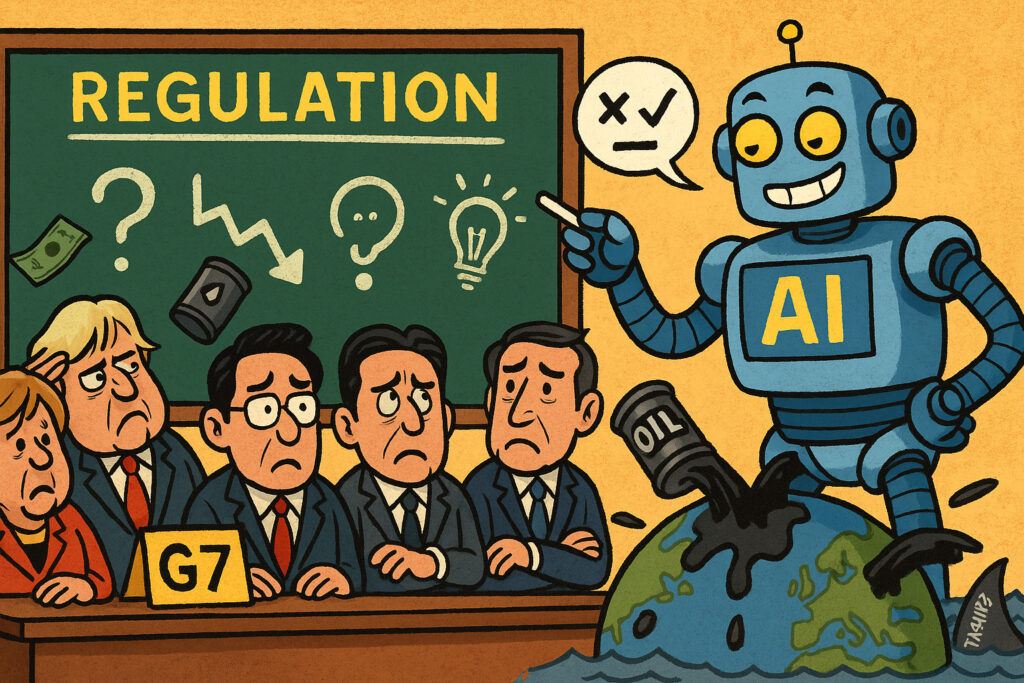

On June 15, 2025, the G7 summit in Ottawa shifted its focus to long-term economic and technological coordination, emphasizing artificial intelligence, digital sovereignty, and cybersecurity. After addressing immediate geopolitical and trade risks earlier in the week, leaders from the United States, United Kingdom, Canada, France, Germany, Italy, and Japan unveiled a joint policy framework aimed at harmonizing AI regulation, securing critical digital infrastructure, and bolstering innovation funding.

While the summit’s opening sessions tackled energy security and supply chain resilience, the latter half turned to charting strategic consensus on future technologies. The G7’s approach is not just regulatory—it is an industrial policy signal. Financial markets responded cautiously, with technology and semiconductor stocks rallying modestly, while AI-exposed firms saw renewed speculative flows.

This article unpacks the G7’s policy declarations, assesses market responses, and evaluates what the summit means for investors in tech, cybersecurity, and global industrial strategy.

G7 Tech Policy Framework: Three Pillars

The G7 joint communiqué released on June 15 outlines the following tech governance priorities:

- Harmonized AI Regulation:

- Establishment of a G7 AI Principles Task Force

- Support for transparent algorithmic auditing standards

- Pledges to protect data privacy and enforce explainability in decision-making models

- Strategic Semiconductor Resilience:

- Launch of the G7 Foundry Alliance to reduce reliance on single-node suppliers

- Incentives for regional semiconductor R&D and cross-border licensing

- Creation of an emergency chip-sharing protocol for critical applications

- Cybersecurity and Critical Infrastructure:

- New standards for protecting 5G and satellite communications systems

- Mandatory cyber resilience testing for banks, hospitals, and logistics firms by 2026

- Intelligence-sharing frameworks to combat state-sponsored cyberattacks

The communiqué also called for stronger antitrust coordination against monopolistic behavior in digital platforms and tighter rules on AI-generated misinformation.

Market Reaction: Tech Stocks Lift but Cautious Tone Prevails

Financial markets saw modest movement on June 15:

- Nasdaq Composite: +0.5% to 16,240.18

- S&P 500: +0.3% to 5,205.62

- Dow Jones: +0.1% to 39,110.24

Gains were concentrated in:

- AI Software: Palantir (+4.2%), C3.ai (+3.9%)

- Semiconductors: ASML (+3.1%), AMD (+2.8%), TSMC ADRs (+2.5%)

- Cybersecurity: CrowdStrike (+3.0%), Palo Alto Networks (+2.7%)

The market viewed the summit as supportive for long-term investment in digital infrastructure, though the regulatory emphasis added a layer of caution.

Currency and Bond Markets: Minimal Disruption

Currency markets were steady:

- DXY (U.S. Dollar Index): 105.50 (flat)

- EUR/USD: 1.0715

- USD/JPY: 159.1

Bond markets remained calm:

- 10-year U.S. Treasury yield: 4.33%

- German Bund 10-year: 2.48%

Investors saw no immediate inflationary or rate-shifting consequences from the G7’s tech framework.

Investor Implications: Strategic Capital Deployment

The G7 framework sends several signals for investors:

- AI Adoption Curve: Formal regulation may accelerate enterprise adoption by lowering compliance risk

- Semiconductor Capacity: Chipmakers with geographic diversification are poised to benefit

- Cybersecurity: Mandates imply multi-year growth in endpoint protection, identity verification, and network security spending

ETF flows on June 15 reflected these themes:

- ROBO (AI & Robotics ETF): +$250 million

- SOXX (Semiconductor ETF): +$360 million

- HACK (Cybersecurity ETF): +$180 million

Broader Geopolitical Context

The G7’s tech focus is partly shaped by competition with China, which continues to scale its own AI and digital infrastructure programs. The communiqué avoided direct mention of Beijing but emphasized “rules-based digital cooperation.”

U.S. officials privately briefed allies on potential export controls targeting advanced chipmaking tools, and Japan indicated support for tighter supply chain scrutiny.

Analysts expect future G7 summits to expand the framework into biotech, quantum computing, and digital currency interoperability.

Conclusion

June 15 marked a turning point at the G7 summit, where economic diplomacy pivoted from crisis management to long-term technological strategy. The consensus around AI governance, chip resilience, and cyber standards reflects a deepening alignment among developed economies.

For investors, the day reaffirmed several structural narratives:

- AI regulation can be a catalyst for scaled adoption

- Digital infrastructure investment is a bipartisan and global priority

- Cybersecurity demand will be structurally supported by regulation

Markets are still digesting the implications, but June 15 set the stage for a more coherent global tech policy ecosystem. For the second half of 2025, tech portfolios will be shaped not just by innovation—but by policy scaffolding now being built in Ottawa.