Introduction

On April 10, 2025, the financial world turned its attention to the release of the Federal Reserve’s March meeting minutes. Investors and analysts were eager to extract signals on the future of U.S. monetary policy. What they found was not a unified front, but rather a clear indication of divergence among members of the Federal Open Market Committee (FOMC) regarding the path forward for interest rates.

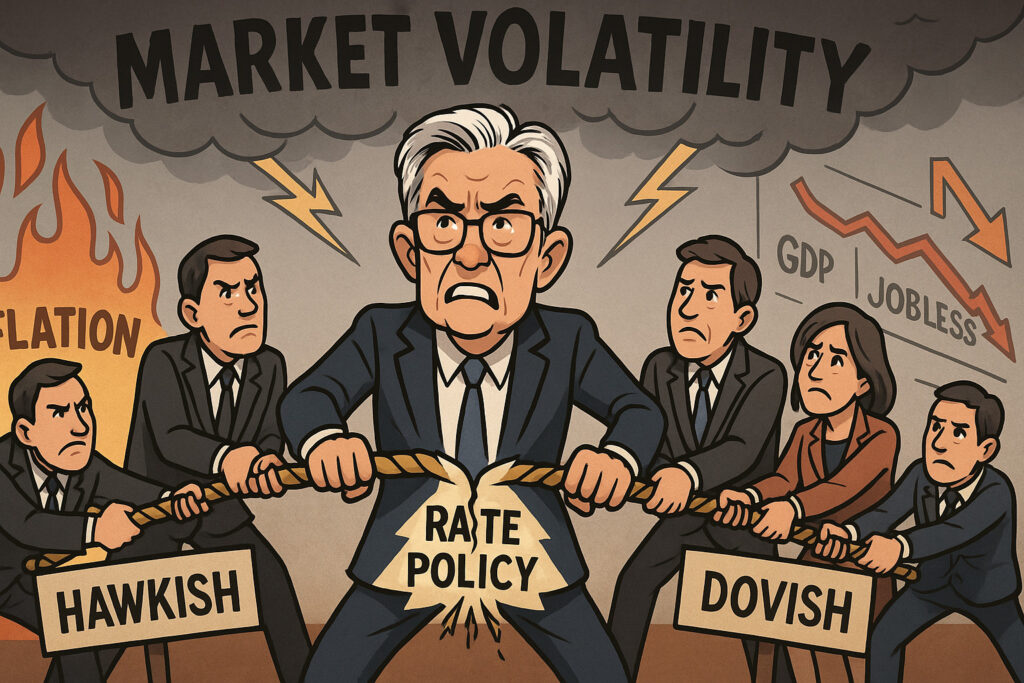

The published minutes revealed a complex and divided Federal Reserve navigating a challenging economic landscape. With inflation still above target and signs of economic deceleration becoming more apparent, policymakers are weighing trade-offs with increasing caution. The market reaction was swift and sharp: volatility surged, equities wobbled, bond yields fluctuated, and safe-haven assets saw increased demand.

This article explores the contents of the Fed minutes, the implications of the internal divisions, how markets responded, and what might lie ahead for investors trying to interpret a murky policy outlook.

Dissecting the Fed Minutes

Interest Rate Stance

The FOMC opted to maintain the federal funds rate within the range of 4.25% to 4.50% during its March meeting. This decision came amid sustained inflationary pressures and robust labor market conditions. However, the minutes underscored that this decision was not unanimous in sentiment. Several members expressed concern that holding rates steady might not be sufficient to curb inflation that continues to run above the Fed’s 2% target.

Other members, meanwhile, highlighted the risks of over-tightening in an environment where signs of economic slowdown are beginning to emerge. They warned that further rate hikes could precipitate a sharper-than-expected downturn, particularly in interest-sensitive sectors such as housing and capital-intensive industries.

Economic Projections

The Fed revised its economic projections, reflecting growing caution about the broader outlook. Real GDP growth for 2025 was downgraded from 2.1% to 1.7%, signaling the Fed’s expectations of slowing economic momentum. On the inflation front, core PCE projections were revised upwards from 2.6% to 2.8%, reinforcing the notion that inflation remains stubbornly persistent.

This dual dynamic—softer growth and sticky inflation—is complicating the Fed’s policy calculus. As the minutes revealed, there is no clear consensus on which risk merits greater concern: the risk of doing too little on inflation or the risk of doing too much and stalling economic growth.

Balance Sheet Policy

Another focal point of the minutes was the Fed’s approach to quantitative tightening (QT). The Committee agreed to slow the pace of balance sheet reduction, reducing the cap on monthly Treasury securities redemptions from $25 billion to $5 billion. The rationale behind this move was twofold: maintaining sufficient liquidity in financial markets and avoiding unintended tightening of financial conditions.

However, this decision too was met with differing views. Some members, notably including Governor Christopher Waller, argued against scaling back QT, expressing concern that a less aggressive runoff could undermine the Fed’s credibility in fighting inflation.

Divergence Among Officials

Perhaps the most striking aspect of the minutes was the palpable sense of division among FOMC members. The normally consensus-driven institution appeared more fractured, with a number of officials laying out sharply differing views on the appropriate trajectory of monetary policy.

Some advocated for a preemptive tightening approach to re-anchor inflation expectations, fearing a repeat of the inflationary cycles of the 1970s. Others pointed to more recent data indicating a moderation in consumer spending, weakening business investment, and signs of stress in credit markets—factors suggesting the need for a more cautious stance.

Market Reactions

Equities

Markets responded to the Fed’s internal disunity with increased volatility. The S&P 500 opened lower before clawing back losses to finish marginally higher. Investors seemed to oscillate between relief that the Fed might pause further hikes and concern that policy uncertainty itself could become a headwind for equities.

Technology stocks, which had been leading the broader rally in the first quarter, showed particular sensitivity. The Nasdaq 100 experienced intra-day swings as traders reassessed growth valuations in light of potentially tighter financial conditions. Bank stocks, which benefit from higher interest rates but are also exposed to recession risk, traded mixed.

Bonds

Bond markets also reflected the heightened uncertainty. Treasury yields initially fell as some traders bet that the Fed’s divisions could lead to a policy pause or even a pivot. However, the move was not one-directional. The yield curve steepened slightly, with short-term yields falling more than long-term yields, indicating shifting expectations about rate cuts later in the year.

The market for inflation-protected securities (TIPS) also saw action, with breakeven inflation rates ticking up—signaling that investors are not yet convinced that inflation is under control.

Gold and Safe-Haven Assets

Gold prices climbed higher as investors moved into safe-haven assets. With real yields under pressure and monetary policy outlook uncertain, gold regained its appeal as a portfolio hedge. The precious metal’s gains were complemented by increased demand for the U.S. dollar and a rally in defensive sectors like utilities and consumer staples.

Cryptocurrencies

Bitcoin and other digital assets saw mild declines. The risk-off sentiment triggered by the Fed minutes weighed on the crypto market, which has historically been sensitive to macroeconomic shocks and shifts in liquidity conditions. Despite growing institutional adoption, cryptocurrencies remain speculative assets in the eyes of many institutional players.

Implications for Monetary Policy

A Data-Dependent Fed

One of the clearest takeaways from the minutes is that the Fed is becoming increasingly data-dependent. With no internal consensus, future decisions will likely hinge on real-time economic indicators. This includes monthly jobs reports, inflation data, consumer confidence surveys, and global developments.

Market participants should brace for greater sensitivity to macroeconomic releases, as each data point could swing the policy pendulum one way or the other. This dynamic is likely to sustain elevated levels of market volatility through the second quarter.

Communication Challenges

The Fed’s communication strategy is under renewed scrutiny. As divisions become public, the risk of mixed signals to the market increases. Investors may struggle to interpret whether statements reflect the consensus of the Committee or the views of a vocal minority. This uncertainty can lead to more reactive markets and potentially unintended tightening or easing of financial conditions.

Going forward, expect Fed Chair Jerome Powell to play a central role in managing these perceptions. His public appearances, press conferences, and testimonies before Congress will be critical in anchoring expectations and preserving the Fed’s credibility.

Geopolitical and Global Influences

Compounding the Fed’s domestic challenges are international uncertainties. Geopolitical tensions—particularly in the Middle East and Eastern Europe—pose risks to global commodity prices and investor sentiment. Meanwhile, slowing growth in China and divergent central bank policies across the Eurozone and Japan add another layer of complexity.

The Fed cannot operate in a vacuum. Global capital flows, exchange rates, and trade dynamics are all impacted by U.S. monetary policy, and vice versa. A divided Fed increases the difficulty of navigating this interconnected environment.

Conclusion

The release of the March FOMC meeting minutes on April 10 has cast a spotlight on the growing rifts within the Federal Reserve. While unity and consensus have long been hallmarks of the Fed’s institutional approach, the current economic environment has made such cohesion harder to maintain.

Faced with competing pressures of persistent inflation and slowing growth, Fed officials are divided on the best course of action. This internal discord has injected a fresh wave of uncertainty into financial markets, leaving investors to navigate an increasingly complex and dynamic landscape.

For now, the path forward remains data-driven. But as the Fed itself becomes less predictable, so too will the markets it seeks to guide. In the months ahead, close attention to both economic indicators and Fed communications will be paramount. Volatility, it seems, is here to stay.