Introduction

On July 25, 2025, the Federal Reserve held its benchmark interest rate steady at 5.25%–5.50%, as widely expected, but the tone of its communication shifted in a more cautious direction. Fed Chair Jerome Powell emphasized rising trade-related uncertainties and slowing labor market dynamics, while acknowledging growing internal debate over the appropriate timing for potential rate cuts.

This was the fourth consecutive meeting where the Fed kept rates unchanged, reinforcing a data-dependent stance. However, this month’s Federal Open Market Committee (FOMC) statement included new language referencing “geopolitical headwinds” and “deteriorating external demand”—a nod to escalating U.S.-China trade tensions and weak global PMIs.

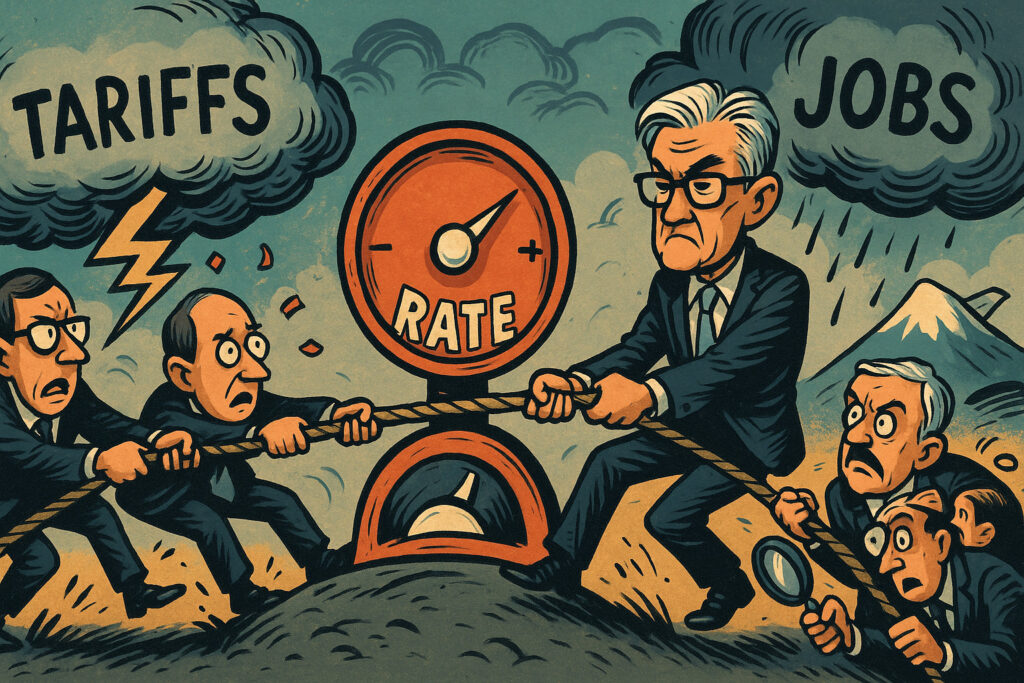

Importantly, Powell’s post-meeting press conference highlighted a growing divide within the Committee. While some members argue inflation remains too sticky to justify easing, others warn that holding policy too tight amid weakening jobs data could risk a sharper downturn.

Markets reacted cautiously: Treasury yields slipped, equities ended mixed, and the dollar fell modestly. Traders are now split on whether the Fed will deliver its first rate cut as early as September or wait until December.

This article breaks down the Fed’s latest decision, analyzes market reaction across asset classes, and explores what the growing dissent within the central bank means for investors and the U.S. economy in the second half of 2025.

Body

Fed Keeps Rates Unchanged, Highlights External Risks

At the conclusion of its two-day meeting, the FOMC released a policy statement that maintained the federal funds target range at 5.25%–5.50%, marking one full year of holding at peak levels. While the rate itself was unchanged, the language surrounding the decision evolved.

Key Excerpts from the Statement:

- “Recent indicators suggest that the economy continues to expand at a modest pace, though risks to the outlook have increased.”

- “Trade developments and external demand conditions are being monitored closely.”

- “The Committee remains highly attentive to inflation risks but recognizes signs of labor market softening.”

This marked the first explicit reference to trade policy and external demand since 2019, reflecting concerns over the renewed tariff escalation between the U.S. and China.

The vote was 9–2, with Minneapolis Fed President Neel Kashkari and Chicago Fed President Austan Goolsbee dissenting in favor of a 25-basis-point rate cut, citing labor market deterioration.

This was the first split decision of 2025 and underscores the growing tension between inflation vigilance and recession risk.

Powell Acknowledges Divided Committee, Reiterates Data Dependence

In his press conference, Fed Chair Jerome Powell struck a balanced tone, emphasizing that the Fed is not yet confident enough to pivot but is increasingly mindful of the risks of overtightening.

“We are in a complex environment where inflation has moderated but remains above target, and where economic momentum is uneven. Some sectors are clearly slowing—particularly labor and housing—while others remain firm.”

When asked about the growing internal dissent, Powell acknowledged that views are diverging:

“There is an active debate within the Committee. Some members see scope to begin reducing the policy rate later this year if disinflation persists. Others prefer to see more evidence.”

Importantly, Powell downplayed the July jobs report’s weakness as possibly “seasonally skewed,” but said it would “weigh heavily” in upcoming assessments.

Market Reaction: Mixed as Investors Digest Nuance

Markets interpreted the Fed’s tone as incrementally dovish but not yet conclusive enough to prompt aggressive repricing.

Equities

- S&P 500: -0.2% to 5,395

- Nasdaq Composite: -0.3% to 17,030

- Dow Jones Industrial Average: +0.1% to 39,285

Equities were mixed, with cyclicals underperforming while defensive names held up. The Nasdaq slipped slightly after recent gains, while the Dow eked out a gain on strength in financials and energy.

Tech stocks were particularly sensitive to Powell’s comments about external demand risks, given their exposure to global supply chains.

Bonds

- 10-year Treasury yield: fell 5 bps to 3.92%

- 2-year yield: dropped 7 bps to 4.11%

Yields declined modestly as traders increased bets on a policy pivot later this year. Futures markets now price in a 62% probability of a rate cut in September, up from 48% a week ago.

The yield curve remains inverted, but the spread between 2s and 10s narrowed slightly to -19 bps, reflecting declining short-end yields.

Dollar

- Dollar Index (DXY): -0.4% to 104.5

- EUR/USD: rose to 1.090

- USD/JPY: fell to 139.3, extending yen strength after the BoJ’s pivot

- USD/CNY: remained stable at 7.40

The dollar’s decline was broad-based and reflected both the Fed’s dovish tilt and expectations of reduced rate differentials following Japan’s and the ECB’s policy shifts.

Inflation Data Still Mixed

The Fed’s decision comes just two days ahead of the June Core PCE inflation report—the Fed’s preferred price gauge—which is expected to show a further decline:

- Consensus forecast: +0.2% MoM, +2.5% YoY

The prior reading stood at 2.6%, down from a peak of 5.4% in 2022. Goods inflation has eased considerably, but services inflation remains sticky, especially in shelter and healthcare.

Powell noted that while disinflation has progressed, “there remains a long path to achieving a sustained return to 2%.” He also acknowledged that base effects may help compress YoY inflation figures through Q3, but structural pressures persist.

Labor Market Concerns Mount

The July 5 jobs report, showing just 42,000 net job additions and a rise in the unemployment rate to 4.3%, loomed large over this week’s meeting. Powell said the Fed is “monitoring labor developments carefully,” and several analysts believe the Full Employment side of the Fed’s dual mandate is becoming more prominent.

Notably:

- Job openings have declined for seven straight months

- Wage growth is decelerating, with average hourly earnings up just 0.1% MoM

- Labor force participation has stalled at 61.3%

Several regional Fed surveys and corporate earnings calls have hinted at slower hiring, particularly in retail, logistics, and hospitality. While layoffs remain contained, hiring freezes are becoming more common.

This labor market fragility is driving the internal push for rate cuts, especially from more dovish members.

Equity and Sector Implications: Rotation May Be Brewing

The Fed’s patient, but increasingly cautious stance could reshape equity leadership in the second half of the year. If policy easing arrives later in 2025, rate-sensitive sectors like:

- Small caps (Russell 2000): may benefit from lower borrowing costs

- Utilities and REITs: could rebound if real yields fall

- Financials: outlook remains mixed—steeper yield curves help, but loan demand is weakening

Meanwhile, tech and growth stocks, which have led YTD, may pause as valuations stretch and earnings comparisons grow tougher.

The S&P 500 forward P/E ratio currently stands at 21.6x, above the 10-year average of 17.9x, suggesting limited room for further multiple expansion without earnings acceleration or rate cuts.

Commodities React to Dollar Weakness

Commodities posted modest gains, aided by a weaker dollar and dovish Fed interpretation.

- Gold: +0.7% to $2,645/oz

- Silver: +1.4% to $31.80/oz

- Brent crude: +0.5% to $82.60/barrel

Precious metals continue to benefit from both safe-haven demand and falling real rates. Industrial metals like copper also gained slightly (+0.6%) on a weaker greenback and improving Chinese PMI data earlier this week.

Crypto Rebounds as Rate Bets Shift

Cryptocurrencies responded positively to the Fed’s tone, with gains across major tokens:

- Bitcoin (BTC): +2.3% to $82,930

- Ethereum (ETH): +2.0% to $4,415

- Solana (SOL): +3.8% to $185

ETFs tracking crypto exposure also saw net inflows, particularly as investors recalibrate portfolios in anticipation of looser policy.

- iShares Bitcoin Trust (IBIT): +$205 million inflow

- Fidelity Wise Origin Bitcoin ETF (FBTC): +$147 million

Options data indicates growing demand for upside protection, with BTC call skew rising to its highest since May.

Global Central Bank Watch

The Fed’s decision is part of a broader global shift toward policy re-evaluation. This week alone:

- Bank of Japan moved away from yield curve control

- ECB minutes hinted at concerns over growth despite sticky inflation

- Bank of England remains on pause but is facing rising political pressure to cut ahead of the October election

Expectations are now building for synchronized easing among major central banks by Q4, though the exact timing will vary.

What’s Next: Data Will Determine the Path

The Fed’s July meeting set the stage for a potential policy pivot, but data will determine the timing and magnitude. Key releases in the coming weeks include:

- June Core PCE (July 26): critical for confirming inflation progress

- Q2 GDP (July 30): expected at +2.1% annualized

- July Jobs Report (August 2): will test whether labor softness is persistent

Markets will also closely watch corporate earnings, particularly from rate-sensitive sectors like housing, autos, and consumer finance.

Conclusion

The July 25 FOMC meeting marked an inflection point in the Fed’s 2025 narrative. While rates were held steady for the fourth straight meeting, Chair Powell’s acknowledgment of growing economic headwinds and internal disagreement over the next steps signals that the debate over rate cuts is now fully active.

With inflation slowing but not defeated, and labor markets showing cracks, the Fed is navigating a complex landscape. The outcome will depend on incoming data—but for the first time this year, dissent is growing, and a shift in policy may not be far off.

For investors, the key takeaways are:

- The Fed is closer to cutting, but not yet committed

- Labor market data and inflation prints will be decisive

- Market leadership could rotate if easing begins later this year

- Global policy synchronization is becoming more probable

As the macroeconomic environment grows more nuanced, so too must portfolio strategy. The coming weeks could determine whether the Fed ends 2025 with rates still at peak—or whether a new easing cycle begins.