March 20, 2025

On March 19, 2025, the Federal Reserve left its benchmark interest rate unchanged at a range of 4.25% to 4.50%, as widely anticipated by financial markets. However, it was the accompanying Summary of Economic Projections (SEP) and the updated “dot plot” that captured investor attention, revealing notable divergences between Federal Reserve officials’ expectations and those priced into market instruments.

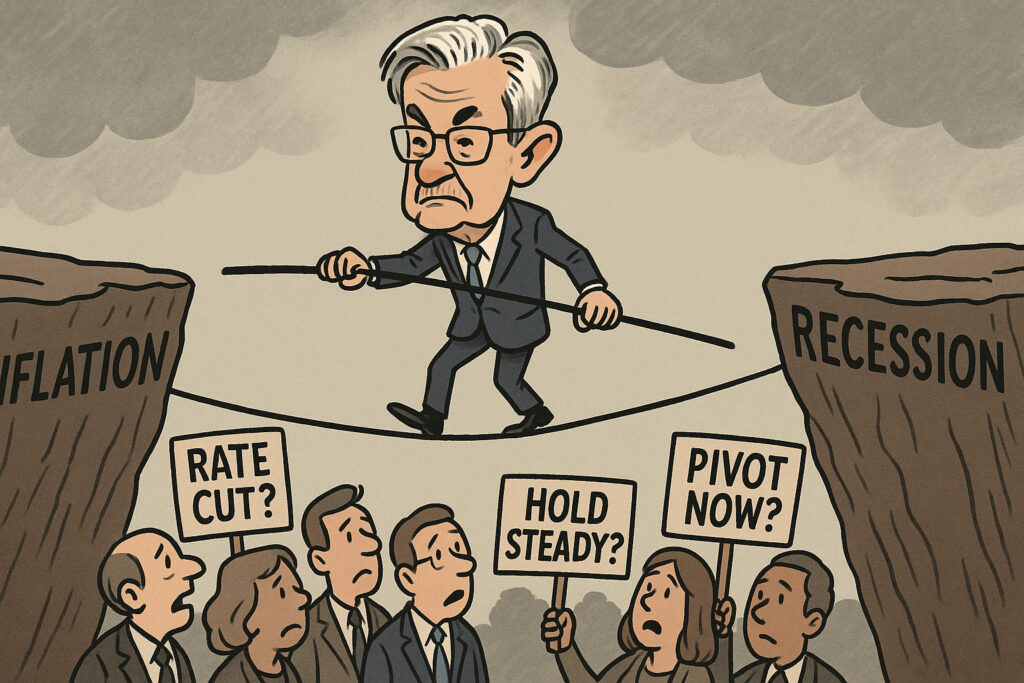

While the rate hold was not surprising, the tone of the projections and the diversity within the dot plot sent a strong signal that the road to monetary easing may be more complex and cautious than investors had hoped.

Summary of the March FOMC Decision

The Federal Open Market Committee (FOMC) voted unanimously to keep the federal funds target range steady, maintaining a restrictive stance in response to inflation that remains above the central bank’s 2% target. Chair Jerome Powell emphasized that while inflation has come down from its peak, the Fed still requires more evidence of sustainable progress before beginning a rate-cutting cycle.

Updated Economic Projections

The SEP reflected modest revisions across major macroeconomic indicators for 2025:

- Real GDP Growth: The Fed now sees growth at 1.7% for the year, down slightly from the 1.9% projected in December. This downward adjustment suggests policymakers are preparing for a deceleration in economic activity amid tighter credit conditions and waning consumer spending.

- Inflation: Core PCE inflation is projected to end 2025 at 2.7%, up from the prior estimate of 2.5%. This upward revision underscores the persistence of underlying price pressures, particularly in services and shelter components.

- Unemployment: The jobless rate is expected to tick higher to 4.4% by year-end, suggesting that labor market cooling is anticipated but not severe. The Fed still views the labor market as strong but no longer overheated.

These forecasts illustrate a cautiously hawkish posture, balancing inflation vigilance with growing acknowledgment of slowing momentum in economic growth.

The Dot Plot Surprise

Perhaps the most closely scrutinized element of the release was the dot plot—a chart summarizing individual FOMC members’ expectations for interest rates over the coming years. The median projection for 2025 implies two 25 basis point rate cuts, bringing the target range to around 3.75%–4.00% by year-end. This represents a slightly more hawkish stance than markets had priced in, with fed funds futures implying three to four cuts by December.

However, the wider-than-usual dispersion in projections raised eyebrows. While several members forecast just one rate cut or none at all, others projected as many as three. This lack of consensus underscores deep uncertainty within the committee about the path forward, contingent on future data.

Powell’s Press Conference: Caution and Flexibility

In his post-meeting press conference, Chair Powell struck a delicate tone. He reiterated the Fed’s data-dependent approach, noting that although inflation has moderated, it remains unacceptably high. Powell emphasized that the Fed will not hesitate to maintain current rates longer if inflation fails to move decisively toward target levels.

Importantly, Powell also acknowledged emerging risks to the economic outlook, including slowing consumer demand, tighter lending standards, and a potential slowdown in job creation. However, he maintained that the economy remains on solid footing and dismissed concerns about an imminent recession.

Powell avoided committing to a timeline for the first rate cut, instead emphasizing that the decision will depend on the evolution of inflation and labor market conditions. His remarks suggested that while a pivot is likely later in the year, it is far from guaranteed.

Market Reaction: Volatility Returns

Markets reacted with caution and renewed volatility following the Fed’s announcements. While investors were prepared for a hold, the reduced certainty around future cuts introduced fresh anxiety.

- Equity Markets: The S&P 500 declined by 0.6% on Wednesday, while the Nasdaq Composite fell 0.9%. Sectors most sensitive to interest rates—such as real estate and technology—were among the biggest losers.

- Bond Market: Yields on 10-year U.S. Treasuries dipped 4 basis points to 4.08%, reflecting increased demand for safe-haven assets amid growing uncertainty. Shorter-duration yields were more stable, indicating a re-pricing of near-term expectations.

- Currency Markets: The U.S. dollar index strengthened modestly, gaining 0.2% as traders interpreted the Fed’s stance as relatively more hawkish than expected.

The divergence between the Fed’s guidance and market expectations raises the potential for further volatility, especially as investors adjust their strategies to account for fewer or later rate cuts.

Market Sentiment and the Fed’s Credibility

The varied dot plot and Powell’s careful language point to a Fed grappling with uncertainty and risk. The market’s prior enthusiasm for imminent rate cuts now appears somewhat premature, especially in light of sticky inflation data and solid consumer activity in early 2025.

Investors are beginning to question whether they were too optimistic in pricing in rapid easing. This shift in sentiment could weigh on risk assets in the short term and lead to renewed scrutiny of upcoming economic indicators.

From a credibility standpoint, the Fed’s challenge is to maintain investor confidence while managing complex tradeoffs. The widening gap between market pricing and policymaker forecasts could create communications challenges if the economic data do not clearly support one narrative over the other.

Key Economic Risks Ahead

Several key risks are shaping the Fed’s outlook and will continue to do so over the coming months:

- Inflation Persistence: While goods prices have stabilized, services inflation remains stubbornly high. Any renewed uptick in energy or housing costs could further delay easing.

- Labor Market Adjustment: If job growth slows too abruptly, the Fed could face pressure to pivot more quickly—risking inflation re-acceleration if cuts come prematurely.

- Global Macro Trends: Developments in China’s economy, renewed geopolitical tensions, and commodity market instability could spill over into U.S. economic performance.

- Financial Conditions: Tightening credit availability, particularly for small businesses and consumers, could amplify downside risks to growth.

Implications for Investors

For investors, the message is clear: expect more volatility and prepare for a longer path to easing. Fixed income markets may see curve flattening as expectations for short-term cuts moderate. Equities could face valuation pressure, especially in rate-sensitive sectors like tech and real estate.

On the flip side, higher-for-longer rates could support sectors such as financials, which benefit from higher net interest margins. Commodities might also attract inflows if inflation remains elevated and real yields stay low.

Outlook: What to Watch Next

The next several months will be critical in shaping the trajectory of Fed policy. Key indicators to watch include:

- Monthly CPI and PCE Reports: Clear trends in core inflation will heavily influence the Fed’s comfort level with future easing.

- Employment Data: Slowing job growth without rising unemployment would be ideal—but a sharper deterioration could push the Fed into action.

- Consumer Spending: Weakening demand could bolster the case for rate cuts, while continued strength may delay them.

- Bank Lending and Credit Conditions: The health of the banking sector and credit markets will provide insight into the transmission of current monetary policy settings.

Conclusion

The Federal Reserve’s decision to keep rates steady was expected, but the broader message was far more nuanced. The revised economic projections and a split dot plot suggest a cautious and data-dependent central bank that is wary of premature easing.

Chair Powell made it clear that the Fed will not be rushed by market sentiment. Inflation must show sustained improvement, and economic resilience must be preserved. For now, the path forward remains murky, with both risks and opportunities ahead.

Markets may have to temper their expectations and come to terms with the possibility that monetary policy easing will arrive later—and more slowly—than previously believed.

Investors and policymakers alike will need to remain nimble in what promises to be a complex and uncertain 2025.