Introduction

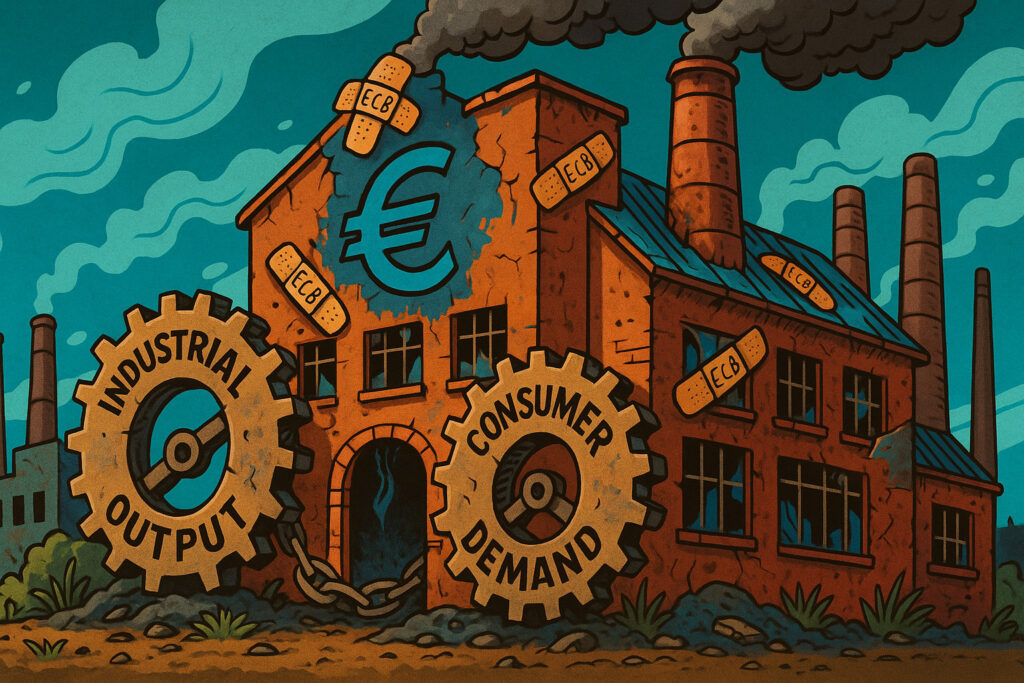

Eurozone economic concerns intensified on July 12, 2025, as fresh data showed a continued contraction in industrial output across the bloc. According to Eurostat, industrial production (IP) fell by 0.6% month-over-month in May, marking the third consecutive monthly decline and a 1.9% drop on an annual basis. The data, which came in well below market expectations of a flat print, reinforced fears that Europe’s manufacturing recession is deepening and could drag the region into a broader economic downturn.

Germany, Italy, and France all reported negative monthly output, while energy production and capital goods orders remained especially weak. The contraction coincides with lackluster consumer demand, a slowdown in global trade, and lingering inflation concerns that continue to restrain European Central Bank (ECB) policy flexibility.

This article dissects the latest industrial production report, assesses reactions across financial markets, and explores the implications for Eurozone growth, inflation, and monetary policy in the second half of 2025.

Industrial Output Declines Across Key Economies

Eurostat’s report detailed widespread softness across the Eurozone:

- Germany: -0.7% MoM; -2.3% YoY

- France: -0.5% MoM; -1.6% YoY

- Italy: -0.8% MoM; -2.1% YoY

- Spain: +0.2% MoM; bucked the trend but remains negative YoY

Sector-wise performance was weak:

- Energy production: -2.4%, due to mild weather and demand suppression

- Capital goods: -1.2%, reflecting reduced corporate investment

- Intermediate goods: -0.9%, tied to soft global trade

- Durable consumer goods: -0.3%, as retail sentiment remained subdued

The data painted a picture of ongoing industrial stagnation amid high input costs, soft external demand, and subdued domestic consumption.

Forward-Looking Indicators Remain Soft

Purchasing Managers’ Index (PMI) readings have also pointed to continued contraction. The Eurozone Manufacturing PMI stood at 47.2 in June, signaling contraction for a 14th consecutive month. New orders and backlogs remain weak, and capacity utilization is slipping.

Surveys from national industry federations suggest business confidence is deteriorating, with forward capex intentions and hiring plans scaling back sharply in Germany and the Netherlands.

Market Reaction: Euro Weakens, Yields Fall

European markets responded with risk aversion:

- Euro Stoxx 50: -0.8%

- DAX: -0.9%

- CAC 40: -0.6%

- FTSE MIB (Italy): -1.1%

The euro fell 0.5% to 1.0690 against the U.S. dollar, its lowest level in two weeks. Bond markets rallied, with the German 10-year Bund yield dropping 5 basis points to 2.39%, reflecting expectations of slower growth and potential ECB easing.

Peripheral spreads narrowed slightly as investors rotated into core debt. Credit markets saw limited movement, although European high-yield spreads widened modestly.

ECB Policy Outlook: Dilemma Deepens

The industrial slump puts additional pressure on the European Central Bank as it seeks to balance disinflation progress with deteriorating growth conditions. Core inflation remains elevated at 2.9% year-over-year, complicating the ECB’s ability to ease aggressively.

ECB President Christine Lagarde reiterated this week that “policy remains data-dependent,” but acknowledged that “downside risks to growth have increased materially.” Markets now price in a 70% chance of a 25-basis-point rate cut by October, up from 52% last week.

Key variables influencing ECB decisions going forward:

- July and August inflation prints

- Q2 GDP (due later this month)

- Labor market resilience

Some Governing Council members have hinted that if industrial and services data weaken further, easing could begin as soon as September.

Broader Implications: Global Spillovers

The Eurozone’s industrial downturn may have ripple effects across global markets:

- Reduced demand for U.S. and Asian exports, particularly machinery, autos, and chemicals

- Softening in global energy and commodity consumption, affecting oil and metals

- Increased pressure on multinational corporate earnings, especially for firms with significant EU exposure

U.S. and Asian equity markets showed mild declines on the Eurozone data, as growth worries weighed on sentiment.

Commodity Markets: Demand Risks Reemerge

Commodities reacted to the weak Eurozone data:

- Brent crude: -1.2% to $71.20 per barrel

- Copper: -1.5% to $4.34 per pound

- Aluminum: -0.9%

Gold remained stable at $2,539 per ounce, supported by safe-haven flows amid heightened recession concerns.

Outlook for H2 2025: Recession Risk Elevated

With manufacturing and industrial output contracting, consumer spending softening, and fiscal constraints limiting stimulus, the Eurozone faces a heightened risk of technical recession. Growth forecasts are being revised lower:

- Q2 GDP consensus: +0.1% QoQ, with downside risks

- 2025 GDP outlook: Now seen at +0.5% for the year, down from +0.8% earlier in the quarter

Private investment is expected to slow further, while household sentiment remains fragile in the face of elevated borrowing costs and sticky inflation.

Conclusion

The latest industrial production figures confirm that the Eurozone economy remains under significant strain, with the manufacturing sector continuing to contract and broader growth momentum deteriorating. The data released on July 12 serve as a wake-up call to policymakers and investors alike, reinforcing the risk of a shallow but prolonged downturn.

Markets are now looking for confirmation in upcoming inflation, labor, and GDP data to assess whether the ECB can pivot toward easing without reigniting price pressures. With the euro weakening and bond yields falling, financial conditions are beginning to ease slightly—but may not be enough to arrest the industrial slowdown.

Investors will closely watch:

- Next week’s final CPI data for June

- ECB communication at the July 25 meeting

- Corporate earnings results from European industrials and exporters

The second half of 2025 will test the region’s resilience, and any delay in monetary support could tip the balance from stagnation into recession. Portfolio caution, defensive sector positioning, and close monitoring of policy signals may be prudent as Europe’s growth engine continues to sputter.