Introduction

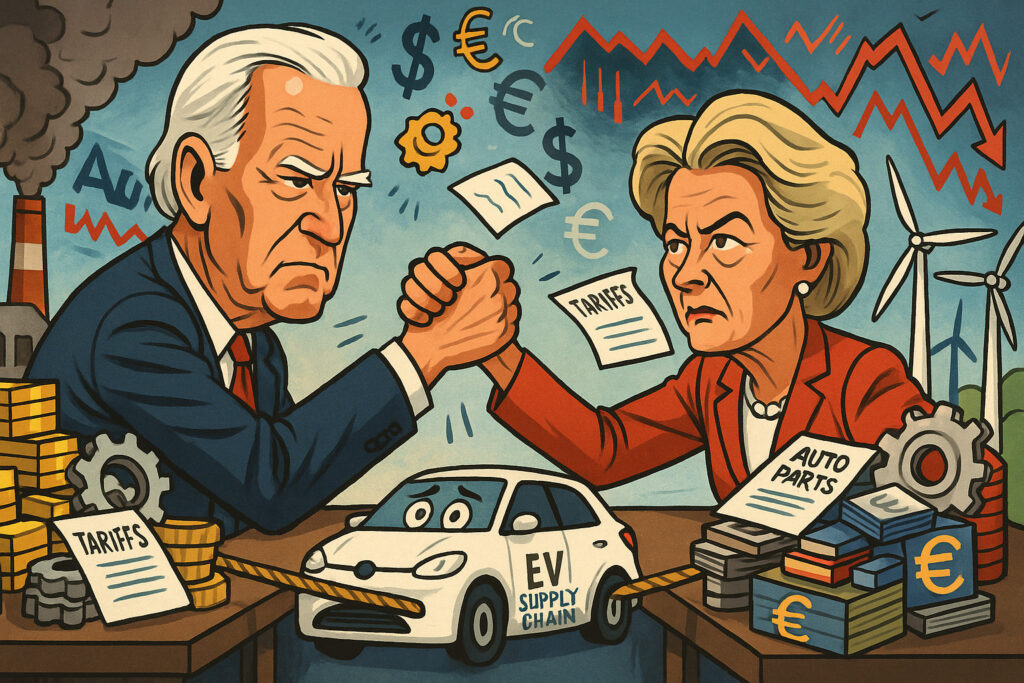

On May 28, 2025, tensions between the United States and the European Union escalated as a long-simmering trade dispute over automotive tariffs took a decisive turn. The U.S. administration confirmed it would proceed with a new set of import duties on electric vehicles (EVs) and auto parts originating from the EU, citing long-standing concerns over unfair trade practices and subsidies. The European Commission swiftly responded, threatening reciprocal tariffs on U.S.-made vehicles and components, setting the stage for a broader trade confrontation.

Financial markets responded with acute sensitivity. Auto stocks across both continents tumbled, while currency markets experienced heightened volatility, particularly between the euro and the U.S. dollar. The move also sent ripple effects through bond markets and safe-haven assets, underscoring investor unease about the broader implications for transatlantic trade, inflationary pressures, and central bank policy outlooks.

This development comes at a critical juncture for the global economy, as both the Federal Reserve and the European Central Bank weigh data-driven decisions on interest rate policy amidst mixed economic signals. The unfolding tariff conflict adds an unexpected variable to the macroeconomic landscape, forcing a recalibration of investor assumptions across multiple asset classes.

Body

Auto Sector Bears the Brunt

Automakers were the immediate casualties of the tariff announcement. In Europe, the STOXX Europe 600 Automobiles & Parts index fell by 3.6%, marking its steepest one-day decline since February 2024. German auto giants Volkswagen AG (-4.2%), BMW AG (-3.9%), and Mercedes-Benz Group AG (-3.7%) led the downturn as markets priced in the potential for significant revenue and margin pressures.

In the United States, shares of Ford Motor Co. dropped 3.4%, while General Motors Co. slid 3.1%. Tesla Inc., which has increased its exposure to European markets through its Berlin gigafactory, saw a more moderate decline of 1.8%, cushioned slightly by its diversified supply chain.

Automotive suppliers were also hit hard. Continental AG (DE) lost 5.0% and Aptiv PLC (U.S.-listed) fell 4.4%. Analysts warned that supply chain complexities and the cross-border integration of production facilities could amplify the cost impact, particularly on EV production, where margins remain tight due to high R&D and battery input costs.

Sector Commentary and Economic Backdrop

The automotive sector has already been grappling with elevated input costs, chip supply imbalances, and a sluggish recovery in Chinese demand. The U.S.–EU tariff confrontation exacerbates these challenges. The potential for higher vehicle prices and disrupted production schedules may also complicate broader inflation dynamics, especially in the EU where consumer inflation has begun to stabilize but remains above the ECB’s target.

Notably, the tariff expansion comes just days after the European Commission proposed a €10 billion subsidy package to support its domestic EV industry, a move the U.S. Trade Representative’s office denounced as “market-distorting.” This policy divergence is central to the trade standoff and reflects broader transatlantic friction on industrial policy, environmental regulation, and economic sovereignty.

FX Volatility: Euro and Dollar Tug-of-War

Currency markets mirrored the uncertainty with notable intraday swings. The euro initially slid as low as $1.076 against the U.S. dollar—its weakest level since mid-April—before rebounding to $1.080 in late European trading. The dollar index (DXY), which measures the greenback against a basket of major currencies, rose 0.3% to 105.42, driven by safe-haven demand and expectations of U.S. economic resilience.

However, volatility was the key story. Implied 1-week EUR/USD volatility jumped to 9.6%, up from a 30-day average of 7.4%, signaling elevated hedging activity among corporates and institutional investors. Currency strategists pointed to uncertainty over retaliatory measures, the potential impact on EU exports, and whether the ECB might need to delay any plans for policy easing.

The euro’s path forward will hinge heavily on political cohesion within the EU. Disparate views among member states—particularly Germany, which has deep auto sector exposure—could complicate Brussels’ response strategy, and by extension, market sentiment toward the single currency.

Broader Equities Impact and Sector Rotation

The broader equity market also reflected risk-off sentiment. The Euro Stoxx 50 closed down 1.7%, with industrials, consumer discretionary, and materials among the worst-performing sectors. In the U.S., the S&P 500 ended the day down 0.9%, while the Dow Jones Industrial Average fell 1.1%. The Nasdaq Composite was relatively resilient, closing flat as tech stocks saw modest inflows amid rotation away from cyclicals.

ETF flows showed clear defensive repositioning. The iShares MSCI Eurozone ETF (EZU) recorded net outflows of $420 million—the highest in a single day since January. Meanwhile, inflows into U.S. utilities and healthcare ETFs surged, suggesting investors are hedging against sector-specific fallout and geopolitical escalation.

Commodities and Trade-Linked Metals

Commodities were mixed in response to the trade dispute. Brent crude oil fell 0.7% to $82.14 per barrel, reflecting concerns that a slowdown in global trade could curb fuel demand. However, base metals were more reactive. Aluminum and copper—both critical to EV manufacturing—dropped 1.9% and 2.3% respectively on the London Metal Exchange (LME), driven by expectations of lower industrial throughput and dampened forward demand.

Gold rose modestly, up 0.5% to $2,368/oz, bolstered by safe-haven flows amid escalating trade rhetoric. The metal has remained range-bound over the past month but could regain upward momentum if geopolitical risks continue to rise.

Bonds and Inflation Expectations

Bond markets offered a nuanced view. In the U.S., the 10-year Treasury yield declined 5 basis points to 4.31%, reflecting a classic flight-to-safety dynamic. The 2-year yield, more sensitive to Fed policy expectations, remained flat at 4.65%, indicating the market does not currently view the tariffs as inflationary enough to shift the Fed’s trajectory.

In contrast, eurozone bonds saw mixed movement. German bund yields fell slightly, with the 10-year dropping 3 basis points to 2.49%, while peripheral spreads widened—Italy’s 10-year yield rose 4 basis points to 3.86%—as investors priced in heightened EU political and economic fragmentation risk.

Breakeven inflation rates in both the U.S. and EU ticked higher by 3–5 basis points, suggesting some market participants are beginning to price in potential supply-side price pressures stemming from trade barriers.

Central Bank Implications

The tariff escalation presents a fresh dilemma for central banks. The Federal Reserve, which recently paused rate hikes amid signs of a cooling labor market and sticky core inflation, must now assess whether trade-induced price effects warrant a shift in policy language. Fed Chair Jerome Powell, in remarks made earlier in the week, reiterated a “data-dependent” stance, emphasizing flexibility amid evolving macro risks.

For the European Central Bank, the calculus is more complicated. ECB President Christine Lagarde is expected to deliver a key speech later this week, and market participants will closely watch for any change in tone. The ECB had been inching toward a dovish tilt based on slowing PMIs and easing inflationary pressures. However, with trade uncertainty threatening both growth and price stability, the bank may adopt a more cautious posture.

Eurozone CPI data due later this week will also be pivotal. A hotter-than-expected reading could delay any rate cuts, especially if accompanied by rising producer price indices reflecting tariff pass-through.

Geopolitical and Regulatory Dimensions

Beyond economics, the tariff escalation signals a broader geopolitical shift. The U.S. move is widely viewed as part of a broader strategy to counter China and fortify domestic supply chains, with the EU caught in the crossfire. Both sides have invoked World Trade Organization (WTO) clauses to justify their positions, but a resolution through the WTO mechanism appears unlikely in the near term.

Analysts also pointed out the political dimension: with U.S. presidential elections approaching in late 2026, trade protectionism may become a bipartisan campaign theme. Similarly, in the EU, rising populist sentiment has increased pressure on Brussels to assert economic sovereignty.

Regulatory divergence is another flashpoint. U.S. officials have criticized the EU’s Carbon Border Adjustment Mechanism (CBAM) as a hidden trade barrier, while the EU remains concerned about the Inflation Reduction Act’s (IRA) preferential subsidies for U.S.-based manufacturers. These underlying tensions suggest that even if a near-term truce is reached, structural misalignments will persist.

Conclusion

The deepening of the EU–U.S. tariff dispute marks a significant inflection point for financial markets and global economic policy. The immediate impact—steep declines in auto stocks, heightened FX volatility, and sectoral reallocation—is already visible, but the longer-term ramifications could be more profound.

Investors must now grapple with a scenario where transatlantic economic cooperation is increasingly subordinated to industrial competition and political calculus. The dispute injects fresh uncertainty into inflation trajectories, corporate earnings forecasts, and central bank decision-making at a time when clarity is most needed.

Looking ahead, several key developments will shape market outcomes:

- Will the European Commission proceed with its threat of retaliatory tariffs?

- How will the ECB and the Fed interpret trade-induced inflation versus slowing growth?

- Can a diplomatic resolution be reached before tariffs materially disrupt Q3 economic data?

As the situation evolves, vigilance and adaptability will be crucial. For now, the tariff conflict serves as a stark reminder that even in a post-pandemic recovery phase, geopolitical and trade shocks remain potent disruptors of market equilibrium.