Introduction

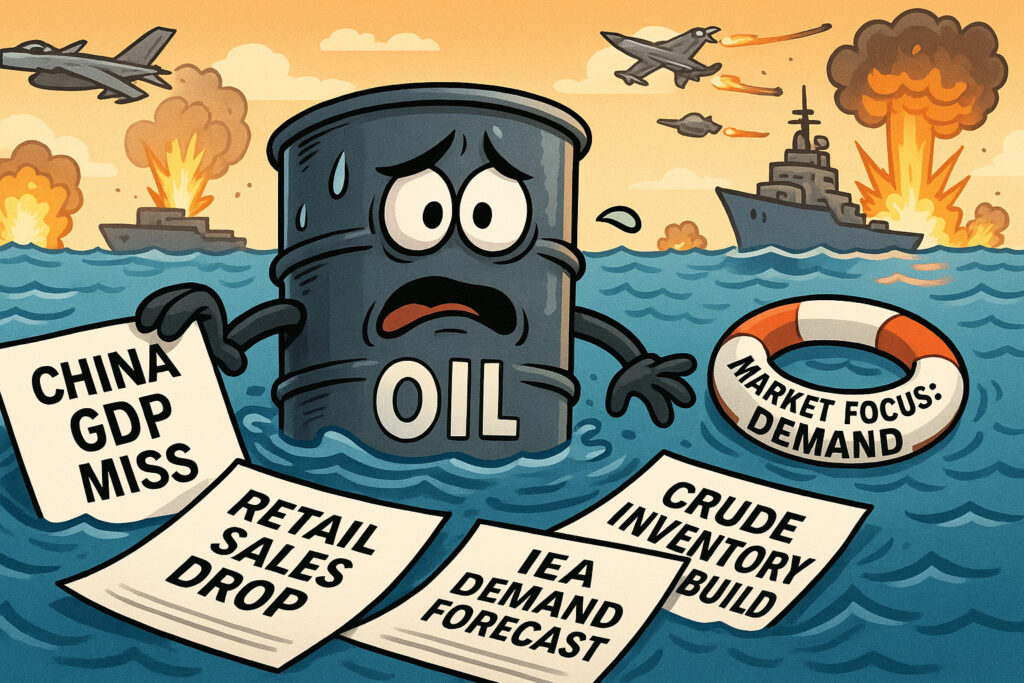

On Tuesday, April 22, 2025, oil markets faced a notable pullback as WTI crude fell below the $90 per barrel mark, driven by persistent demand concerns despite lingering geopolitical tensions in the Middle East. Investors largely shrugged off escalating military posturing near the Strait of Hormuz, choosing instead to focus on fresh economic data from the U.S. and China that cast doubt on the strength of global demand. This shift in focus led to declines in major energy stocks and broader weakness across commodity-linked assets.

The unexpected retreat in crude prices underscores a broader investor sentiment pivot—from supply fears to demand anxieties—and poses a key question: Is the post-winter oil rally losing steam as macroeconomic data turns mixed?

Background

The first quarter of 2025 saw energy prices climb sharply amid multiple bullish catalysts: OPEC+ production cuts, supply disruptions from regional conflicts, and seasonal demand normalization. Brent crude flirted with $94, while WTI soared past $92 in early April. Hedge funds and commodity traders had aggressively built long positions in crude, anticipating a tighter market.

However, this upward momentum began to wane in mid-April. A combination of disappointing economic data from China—still struggling with industrial deflation—and the U.S.—where retail sales and housing starts both showed softness—has challenged the assumption of a robust demand rebound in Q2. Compounding the pressure, recent International Energy Agency (IEA) projections hinted at slower-than-expected oil demand growth for the remainder of 2025.

While tensions between Iran and Western naval forces in the Persian Gulf have intensified, the market’s muted reaction signals that traders are increasingly discounting supply-side risks in favor of more pressing macroeconomic realities.

Today’s Market Reaction

As of market close on April 22:

- WTI Crude (June contract): $88.74/barrel (−2.6%)

- Brent Crude (June contract): $91.11/barrel (−2.3%)

- Natural Gas (NYMEX): $2.02/MMBtu (−1.8%)

- S&P 500 Energy Sector ETF (XLE): $91.43 (−1.4%)

- ExxonMobil (XOM): $114.08 (−1.9%)

- Chevron (CVX): $165.47 (−1.6%)

- Occidental Petroleum (OXY): $64.91 (−2.2%)

Broader equity markets showed mixed results:

- S&P 500: 5,138.22 (−0.1%)

- Dow Jones Industrial Average: 38,442.13 (−0.3%)

- Nasdaq Composite: 16,029.87 (+0.2%)

Currency and bond markets also reacted subtly:

- U.S. Dollar Index (DXY): 105.22 (+0.1%)

- 10-Year Treasury Yield: 4.48% (−3bps)

Interestingly, gold prices held steady, reflecting investor hedging behavior:

- Gold (Spot): $2,321.74/oz (flat)

Analysis

The slide in oil prices reflects a shift in market psychology. For months, the narrative was anchored around constrained supply. Now, the growing dissonance between elevated prices and weaker demand signals is forcing a repricing.

1. Economic Softness from Key Consumers

- China’s Q1 GDP, while officially reported at 4.9%, missed private sector estimates, with industrial production particularly sluggish. April trade data released this morning showed a 2.1% decline in oil imports year-over-year—a red flag for energy bulls.

- In the U.S., March retail sales and housing starts both disappointed, pointing to a consumer that may be increasingly rate-sensitive. The Federal Reserve’s “higher for longer” stance is beginning to bite, with mortgage demand and gasoline consumption tapering off.

2. IEA and OPEC+ Divergence

- Last week, the IEA revised global oil demand growth for 2025 down to 1.1 million barrels per day (mbpd), citing electric vehicle adoption and energy efficiency gains.

- Meanwhile, OPEC+ continues to extend voluntary cuts, with Saudi Arabia and Russia emphasizing price stability over volume. This could backfire if demand fails to meet even these constrained supply levels, leaving the market oversupplied in Q3.

3. Speculative Positioning

- Commitment of Traders (COT) data from the CFTC shows long crude positions at a 3-month high, indicating that recent weakness could trigger further unwinding of speculative bets, leading to short-term downside pressure.

4. Geopolitical Risk Fatigue

- The market seems desensitized to Persian Gulf flare-ups. Despite Iran deploying naval units near key shipping lanes, tanker traffic has yet to be disrupted. Without a direct supply hit, traders are no longer paying a “geopolitical premium” unless real flow disruptions materialize.

Short-Term Outlook

In the coming days, traders will closely monitor:

- U.S. Crude Inventory Data (April 24): A large build could confirm weakening demand and accelerate the decline.

- Big Tech Earnings: With Apple and Microsoft reporting soon, equity markets could pivot sharply, affecting risk appetite and indirectly influencing commodity flows.

- Middle East Developments: Any escalation that physically disrupts oil exports could reignite price spikes, but absent such events, supply-side fears may stay subdued.

- China’s April PMI (April 30): A key indicator of demand revival or further deterioration.

Volatility expectations have risen modestly. The OVX (Oil Volatility Index) moved to 35.1 (+3.4%), signaling elevated risk perception, though not panic.

The next few sessions could see WTI test key support levels at $87.50, with further downside open toward the $85 handle if bearish momentum persists.

Conclusion

April 22 marked a critical turning point for energy markets: a demand-driven correction in oil prices. Despite lingering geopolitical risks, macroeconomic headwinds are increasingly dominant in shaping investor behavior. The re-rating in crude could extend if upcoming data continues to disappoint, and speculative longs unwind in earnest.

For traders and investors, the current environment demands agility and nuance—understanding that oil is no longer trading just on war headlines, but on real-time consumption signals and global growth outlooks.

If supply remains steady but demand falters, the energy sector may have peaked for the season. Eyes now turn to inventories, tech earnings, and macro data for the next directional cues.