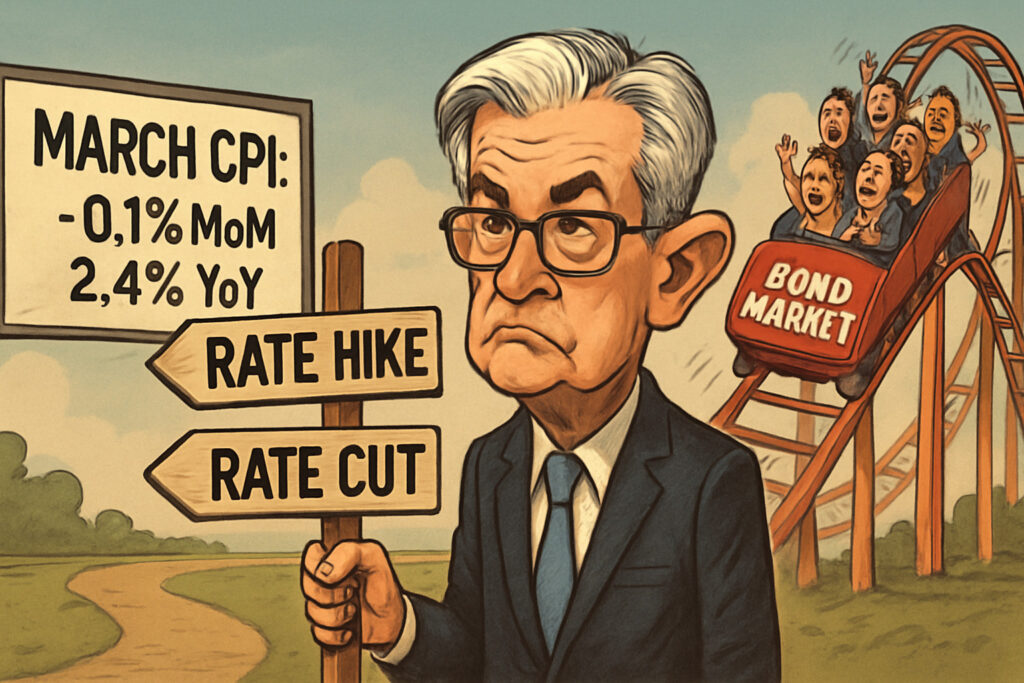

Markets React Sharply to CPI Data on April 12, 2025

On April 12, 2025, financial markets experienced significant volatility following the release of the March Consumer Price Index (CPI) report. The data indicated a 0.1% month-over-month decrease and a 2.4% year-over-year increase in inflation, surprising investors who had anticipated a more substantial decline. This unexpected result led to a selloff in the bond market, as traders recalibrated their expectations for future Federal Reserve policy actions.

Detailed Analysis of the CPI Report

Headline and Core Inflation

- Headline CPI: Decreased by 0.1% in March, marking the first monthly decline since May 2020.

- Core CPI: Increased by 0.1% month-over-month and 2.8% year-over-year, the smallest annual increase since March 2021.

The decline in headline inflation was primarily driven by a 6.3% drop in gasoline prices, while core inflation remained elevated due to persistent increases in shelter and medical care costs.

Energy and Food Prices

- Energy Index: Fell by 2.4% in March, with gasoline prices leading the decline.

- Food Index: Rose by 0.4% in March, with notable increases in meats, poultry, fish, and eggs.

These figures suggest that while energy prices are providing some relief, food prices continue to exert upward pressure on overall inflation.

Bond Market Selloff

The unexpected CPI data triggered a significant selloff in the bond market:

- 10-Year Treasury Yield: Increased to 4.5% by April 9, up from 3.86% on April 4, marking the largest three-day jump since 1982.

- 30-Year Treasury Yield: Surged to 4.92%, reflecting investor concerns about long-term inflation and fiscal policy.

These movements indicate a shift in investor sentiment, with concerns about potential future inflation and the Federal Reserve’s response leading to increased volatility in the bond market.

Federal Reserve’s Stance

In response to the CPI data and market reactions, Federal Reserve officials emphasized a patient approach to monetary policy. Cleveland Fed President Beth Hammack stated that the Fed can continue reducing its balance sheet, citing sufficient reserves in the financial system. She emphasized patience in adjusting interest rates amid economic uncertainty. Similarly, Fed Governor Christopher Waller indicated that there is no immediate need to change interest rates before clearer data emerges, likely by the second half of 2025.

Despite market volatility—partly due to President Trump’s tariff policies—Fed officials believe conditions remain orderly, supporting continued quantitative tightening.

Market Implications and Investor Sentiment

The bond market selloff reflects investor concerns about persistent inflation and the potential for the Federal Reserve to maintain higher interest rates for an extended period. This environment creates challenges for both equity and fixed-income investors, as higher yields can lead to lower stock valuations and increased borrowing costs.

Investors are advised to monitor upcoming economic data releases and Federal Reserve communications closely, as these will provide further insights into the central bank’s policy trajectory. Diversifying portfolios and maintaining a focus on quality assets may help mitigate risks associated with ongoing market volatility.

Conclusion

The March CPI report’s unexpected decline has introduced new complexities into the economic landscape. While easing inflation is a positive sign, the bond market’s reaction underscores the uncertainty surrounding future monetary policy. Investors and policymakers alike will need to navigate these developments carefully, balancing the goals of controlling inflation and supporting economic growth.