Introduction

📅 Friday, April 25, 2025

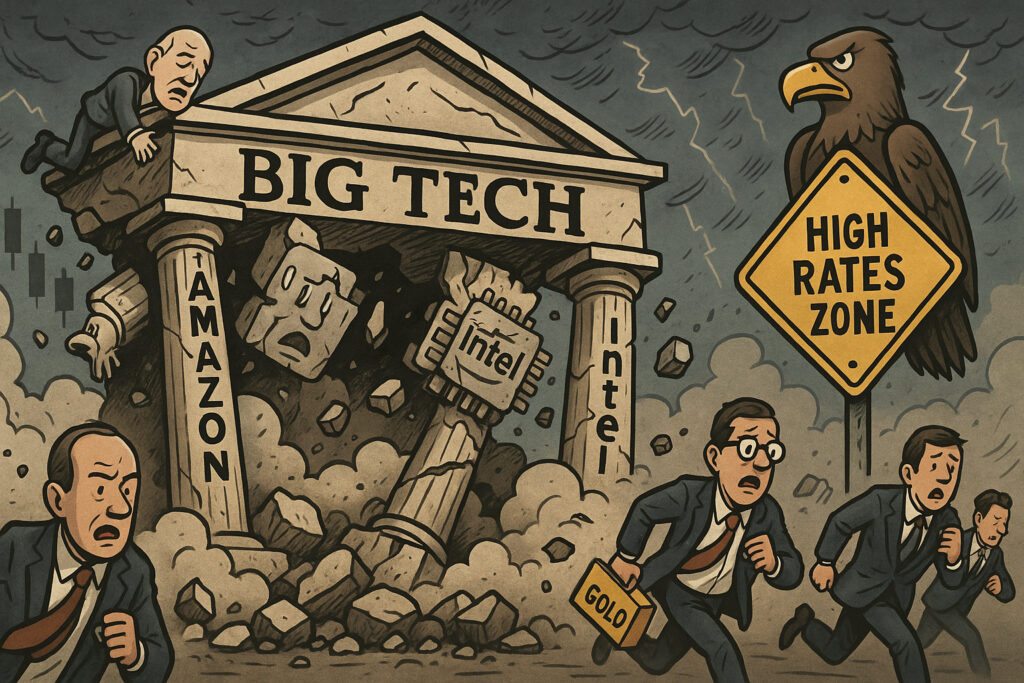

U.S. equity markets ended the week on a sour note as disappointing earnings from Amazon and Intel sent shockwaves through the technology sector. After weeks of anticipation surrounding Big Tech’s Q1 earnings, investors were met with weaker-than-expected guidance and concerning signals about consumer demand and margin pressures. The Nasdaq Composite plunged over 2% on the day, dragging broader markets with it, while safe-haven assets like gold and the U.S. dollar edged higher as risk appetite deteriorated.

Background

The past two weeks have seen a flurry of activity in the earnings season, with Microsoft and Alphabet earlier this week providing a short-lived boost to sentiment after beating expectations. However, investor optimism was tempered by the understanding that not all tech giants would fare equally well in a still-uncertain macroeconomic environment shaped by persistent inflation, cautious consumers, and high borrowing costs.

This week culminated with a crucial double release: Amazon, a bellwether for e-commerce and cloud services, and Intel, a key player in the semiconductor industry, both published their quarterly reports after Thursday’s close. The market had priced in robust results following strong cloud revenues from Microsoft and continued demand in AI-related chip sectors. Instead, Amazon’s cloud growth slowed sharply, and Intel issued a grim outlook, citing weak enterprise demand and prolonged inventory correction in the PC market.

Today’s Market Reaction

📉 Major Indexes (as of market close, April 25, 2025):

- Nasdaq Composite: 15,024.12 ▼ -2.13%

- S&P 500: 5,071.36 ▼ -1.09%

- Dow Jones Industrial Average: 38,126.77 ▼ -0.45%

- Russell 2000: 1,967.45 ▼ -1.84%

🛑 Key Stocks:

- Amazon (AMZN): $154.20 ▼ -7.4%

→ Missed AWS growth estimates; weaker Q2 guidance. - Intel (INTC): $33.61 ▼ -11.9%

→ Revenue down YoY; Q2 forecast well below Wall Street estimates. - Nvidia (NVDA): $826.50 ▼ -2.8%

→ Down in sympathy amid chip sector selloff. - Apple (AAPL): $188.94 ▼ -1.6%

→ Falls ahead of its own earnings next week. - Microsoft (MSFT): $410.23 ▼ -0.9%

→ Giving back some post-earnings gains.

📈 Safe-Haven Assets:

- Gold: $2,352.70/oz ▲ +0.6%

- 10-Year U.S. Treasury Yield: 4.53% ▼ -5bps

- U.S. Dollar Index (DXY): 104.31 ▲ +0.2%

🛢 Commodities:

- WTI Crude Oil: $88.94/barrel ▼ -1.1%

- Brent Crude: $92.13/barrel ▼ -0.9%

📊 Cryptocurrencies:

- Bitcoin (BTC-USD): $62,320 ▼ -1.4%

- Ethereum (ETH-USD): $3,040 ▼ -1.1%

Analysis

Disappointment from Big Tech

Markets had high hopes going into Amazon and Intel’s reports. Both stocks had rallied into earnings, with investor expectations fueled by Microsoft’s blowout Azure performance and a recent recovery in AI enthusiasm. But the actual numbers painted a more sobering picture.

Amazon’s AWS segment, while still growing at 12% YoY, missed expectations for the second consecutive quarter. Management pointed to enterprise clients slowing spending and increasing price sensitivity. Retail operations also underperformed, with North American sales missing and international segments swinging back into the red.

Meanwhile, Intel’s results underscored the company’s deepening struggle to regain relevance in a chip landscape increasingly dominated by Nvidia and AMD. Despite modest gains in foundry business, the company’s core PC and data center units posted double-digit declines. The outlook for Q2 was grim, suggesting only modest improvement despite easier comps.

Together, these earnings sparked a broader repricing of tech valuations. The Nasdaq’s sharp decline reflected concerns not just about these two firms, but about tech margins more broadly amid stubborn cost pressures and an unclear demand environment.

Macro Context Worsens the Blow

Today’s moves came in the context of elevated interest rates and an uncertain Fed outlook. Just yesterday, a trio of Federal Reserve speakers pushed back on rate cut expectations, citing sticky services inflation and a still-resilient labor market. The bond market, already on edge after this week’s CPI revisions and PCE preview, took note: rate futures now imply just one 25bps cut by December, down from two earlier this month.

For tech, the backdrop of higher-for-longer rates is particularly punitive. These firms’ valuations are heavily predicated on future cash flows, which get discounted more heavily as yields rise. With the 10-year yield still hovering above 4.5%, the pressure remains acute.

Sector Rotation Resumes

Today’s selloff may also mark the beginning of another shift: a rotation out of mega-cap tech and into cyclicals and defensives. Financials, energy, and consumer staples outperformed slightly today, with modest inflows seen in ETF data. This hints that asset managers are beginning to rebalance portfolios after a tech-dominated rally in Q1.

Short-Term Outlook

Markets will digest the Amazon and Intel hangover into next week, but the action is far from over. Key catalysts on the radar include:

🗓 Upcoming Events:

- April 26: U.S. Personal Consumption Expenditures (PCE) report – the Fed’s preferred inflation gauge.

- April 30: U.S. Employment Cost Index (ECI) for Q1.

- May 1: FOMC Rate Decision – no change expected, but forward guidance will be critical.

- May 2: Apple and Meta earnings.

Given today’s reaction, traders will be watching closely to see if this marks the start of a broader pullback in tech. Volatility may rise, particularly if inflation data comes in hot or Apple disappoints.

Options market activity shows increased hedging in the Nasdaq-100, with put-call ratios spiking and implied volatility rising for next week’s expirations. Bond yields may also be a factor; any further rise above 4.6% on the 10-year could exacerbate equity selling.

Conclusion

April 25, 2025, served as a sobering reminder that even the tech giants are not immune to cyclical forces and shifting macroeconomic tides. Amazon and Intel’s disappointing results and guidance sent a clear message: cracks are forming in the Big Tech narrative, especially in segments once thought to be insulated from consumer cyclicality and capital expenditure cuts.

With key inflation data and central bank policy decisions looming, investors may need to recalibrate expectations—not only for interest rate cuts but also for continued tech outperformance. Risk sentiment has turned more cautious, and the market’s appetite for disappointment has narrowed.

The next week could be pivotal. If Apple and the PCE report also underwhelm, today’s retreat might just be the beginning of a broader correction. For now, defensive positioning and a more balanced portfolio strategy may be the prudent path forward.