Apple Inc. (NASDAQ: AAPL) released its Q2 fiscal 2025 earnings on May 2, revealing a mixed picture: while total revenues and earnings beat analyst estimates, iPhone demand weakened significantly in the U.S., offset by a sharp surge in Indian sales. The stock initially fell 4.1% in after-hours trading before paring losses slightly as investors processed the company’s geographic shift in momentum and upcoming tariff-related headwinds.

Key Earnings Highlights

- Revenue: $95.4 billion (vs. $90.7B forecast), up 5% YoY

- Net income: $24.78 billion, +4.8% YoY

- EPS: $1.65 vs. $1.50 expected

- iPhone sales: $46.84 billion, +2% YoY

- Services revenue: $26.65 billion, +12% YoY

- Mac revenue: $8.62 billion, +7% YoY

- iPad revenue: $8.34 billion, +15% YoY

- China revenue: down 2.3% YoY

- India revenue (unofficial estimate): over $8B, +40% YoY

Why Did the Stock Drop Despite a Beat?

Although Apple beat Wall Street expectations across most metrics, the stock faced pressure due to three primary concerns:

- Tariff Warning: CFO Luca Maestri warned that upcoming U.S.-China tariff escalations may increase operational costs by up to $900 million in Q3.

- Weak U.S. iPhone Demand: Despite a modest 2% YoY increase in global iPhone sales, U.S. demand has softened due to inflationary pressures, stagnant upgrades, and increased carrier constraints.

- China Market Deceleration: Sales in China, traditionally Apple’s second-largest market, fell 2.3% amid intensified competition from Huawei and Xiaomi, and continued geopolitical tensions.

The stock closed Friday at $187.64, but traded down to $180.04 in after-hours action before recovering slightly to $182.90 by market open on Monday.

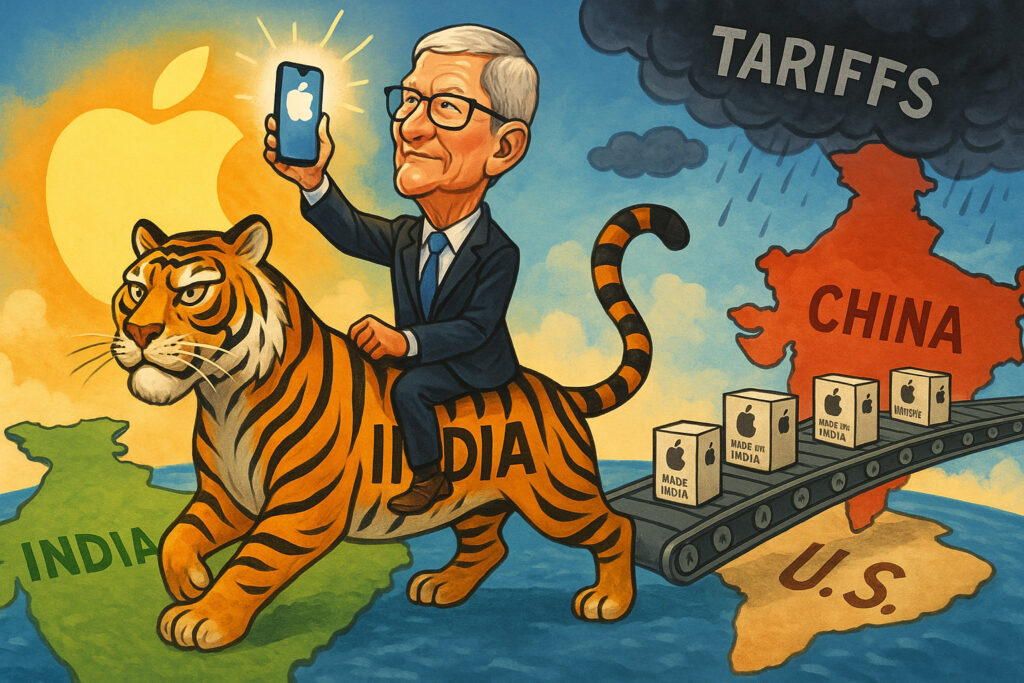

India: Apple’s Emerging Golden Goose

India continues to play a central role in Apple’s long-term growth and supply chain recalibration. CEO Tim Cook emphasized during the earnings call:

“India is now not only a key consumer market but also a foundational hub for our global supply chain strategy.”

Key developments include:

- More than 10% of global iPhone shipments now originate from Indian assembly plants.

- Apple plans to move all iPhone manufacturing for U.S. sales to India by the end of 2026.

- Revenue in India reportedly grew over 40% YoY, driven by aggressive retail expansion and growing aspirational demand for premium devices.

- Tim Cook hinted at launching more regionally priced devices, including a potential “iPhone SE Plus” targeting emerging economies.

India has now surpassed Germany and the UK in revenue generation, becoming Apple’s #5 global market.

Services Segment: A Steady Profit Engine

Apple’s Services division continues to show robust growth and higher margins than hardware:

- Revenue: $26.65 billion, +12% YoY

- Apple Music, TV+, iCloud, and Apple Pay all saw double-digit growth.

- Active paid subscriptions reached 1.2 billion, up from 935 million a year ago.

This segment has become a key focus area as hardware margins come under pressure and macro headwinds challenge device upgrades.

Supply Chain Shift: The “China+1” Strategy in Motion

Amid rising geopolitical risk and tariff exposure, Apple is accelerating its supply chain diversification:

- Expanding iPhone, MacBook, and accessory production in India and Vietnam.

- Reducing reliance on Chinese contractors like Foxconn in favor of localized Indian players.

- Investments into Indian logistics infrastructure exceeded $2 billion in Q2 alone.

This structural shift aims to insulate Apple from U.S.-China frictions while tapping into new markets.

📉 China & the U.S.: Trouble Spots

China

Apple’s sales declined 2.3% YoY in China, continuing a trend of deceleration that began in Q4 2024:

- Huawei’s resurgence with its 5G-capable Mate series is gaining ground among patriotic consumers.

- U.S.-China tech tensions and government curbs on foreign devices in state-owned enterprises have also hurt sentiment.

- Analysts warn this may become a long-term structural risk if Apple fails to regain market share.

United States

- Upgrade cycles are elongating, and device financing is becoming less attractive as interest rates remain elevated.

- Carrier incentives have pulled back, making high-end iPhones less accessible to mid-tier users.

- Retail foot traffic remains below pre-pandemic levels, especially in urban regions.

Forward Guidance & Market Reaction

Apple declined to give formal revenue guidance, citing macroeconomic uncertainties and tariff volatility. However, Maestri said gross margins are expected to be “similar or slightly down” due to increased logistic costs.

Analyst Highlights:

- Wedbush: “India is now Apple’s most strategic growth vector. Still bullish long-term.”

- Barclays: “Tariff exposure and China risk are underpriced by the market.”

- Morgan Stanley: “Services strength reinforces earnings stability despite hardware headwinds.”

The consensus is that Apple’s long-term positioning remains robust, but near-term challenges—especially around tariffs and demand softening in the U.S.—could limit upside.

💡 Conclusion: A Pivotal Quarter of Strategic Reorientation

Apple’s Q2 2025 earnings reflect both strength and fragility. While the Services segment and emerging market growth remain key pillars of resilience, the dual pressures from a weaker U.S. consumer base and geopolitical friction with China are undeniable.

India’s breakout performance—and Apple’s aggressive investment therein—signals a new era where growth won’t be Silicon Valley- or Shanghai-centric, but Delhi-bound. Apple’s ability to pivot, localize, and streamline its supply chain will likely define its next decade.