Introduction

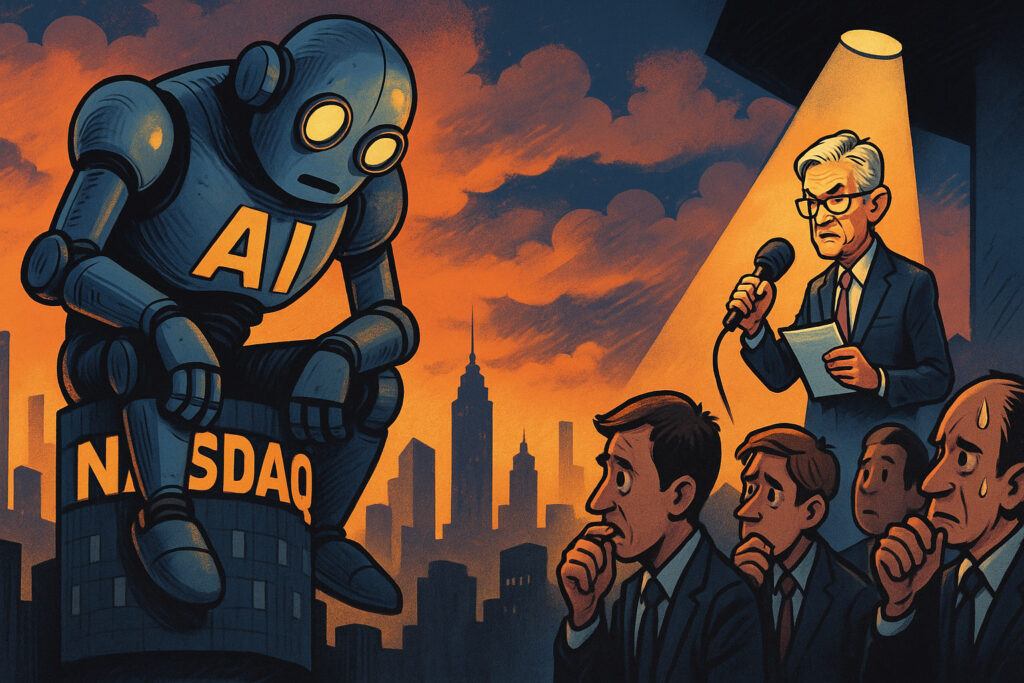

On 20 August 2025, global markets settled into a measured posture as investors contended with growing fatigue in the artificial intelligence sector, mixed consumer earnings, and heightened anticipation ahead of Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium. While defensive market forces, particularly within tech, took hold, broader indices moved more subtly: the S&P 500 dipped modestly, the Nasdaq retraced earlier gains, and the Dow eked out a slight advance. Retail earnings from Target, Lowe’s, and La‑Z‑Boy added nuance to market sentiment, while the UK’s FTSE 100 surged to record levels despite inflation’s persistent rise.

This session is critical as it captures the interplay between fading enthusiasm in a once-stellar growth narrative and the mounting importance of retail health and monetary policy signals. Markets appear to be consolidating ahead of the Fed’s tone-setting communication, balancing resilience in consumption against growing skepticism in AI-driven hype.

U.S. Equities Reflect Guarded Optimism

Major U.S. indices experienced a day of modest shifts. The S&P 500 slipped around 0.2%, paring earlier losses before close, while the Nasdaq fell approximately 0.7%, weighed down by a pullback in previously high-flying technology names . The Dow Jones Industrial Average eked out a slim gain under 0.1%, anchored by defensive and blue-chip names . Broad market volumes were stable, but the tone was decidedly cautious.

Tech Shares Face AI Fatigue

The tech sector, once the vanguard of market momentum, showed signs of fatigued enthusiasm. Investors appear to be stepping back from AI-centric valuations, questioning whether the hype has outpaced fundamentals . The sell-off reflected a broader reassessment of growth narratives. In contrast, companies offering more durable earnings or defensive profiles attracted steadier interest.

Retail Earnings Add Complexity

Retail performance added further layers to market dynamics:

- Target shares plunged around 10% in premarket trading, driven by leadership turnover and underwhelming sales trends despite meeting expectations .

- Lowe’s emerged as a bright spot, jumping over 3% after beating profit projections, raising its full-year guidance, and announcing an $8.8 billion acquisition of Foundation Building Materials .

- La‑Z‑Boy tumbled nearly 25% on disappointing profit and sales forecasts .

These outcomes underscore a bifurcated retail narrative: home-improvement strength juxtaposed with broader consumption softness.

Fed’s FOMC Minutes in Focus Ahead of Powell

Investor attention intensified around the release of the Federal Reserve’s July meeting minutes, which revealed a divided outlook within the FOMC, with inflation concerns dominating economic risk assessments . With Chair Powell’s Jackson Hole speech just days away, markets are bracing for signals that may clarify whether rate cuts are on the horizon or remain uncertain.

UK Markets Defy Inflation with Record High

Across the Atlantic, the FTSE 100 climbed to a fresh record high at 9,283, driven by sector strength despite UK inflation rising to 3.8% in July, a level that dims expectations for near-term BoE easing . This divergence underscores regional differentiation: while UK equities find upside in valuation appeal or cyclical rotation, inflationary pressures persist.

Broader Market Implications

The confluence of fading AI exuberance, reactive retail earnings, and central bank ambiguity produced a complex environment. The modest title gains in the Dow highlighted ongoing investor preference for firms with predictable earnings, while the tech pullback hinted at diminished speculative appetite. This tangled backdrop confirms that markets are in a pause—awaiting clarity before committing to the next trend.

Conclusion

On 20 August 2025, markets tread a fine line between optimism and restraint. The AI sector’s downturn marks a pivotal shift in sentiment, coinciding with fragmented retail earnings and a central bank poised to set the tone at Jackson Hole. The Fed’s messaging could tip investor conviction toward growth or compression, while global divergences—such as the UK outperforming despite inflation—highlight the uneven economic recovery.

As markets prepare for Powell’s speech, investors should assess whether the current recalibration reflects fundamental re-pricing or simply a temporary lull. Key questions moving forward: Will retail trends stabilize consumer confidence? Can central bank policy clarity reinvigorate speculative leadership? Or is this the onset of broader rotation into value and defensives?

The nuanced posture of 20 August positions markets at a crossroads—pendently poised between optimism and caution.